PFIC §1291 Calculation Explained — The Hidden Mechanics Behind Form 8621 Line 16a

This guide provides a deep breakdown of PFIC §1291 computations, focusing on the "punitive" default regime. We explore block-level segmentation, the income-inclusion rule, and the strict foreign-currency ordering required by 26 U.S.C. §1291.

This guide explains the default taxation method under IRC §1291. This regime applies if no QEF or MTM election is in place. It requires extremely granular, daily-level record keeping that usually exceeds the capabilities of standard spreadsheets.

0. When an “Excess Distribution” Occurs

Under §1291, an excess distribution is triggered in two specific scenarios:

- Disposition of PFIC stock: Any gain from a sale is treated "as if" it were an excess distribution. Effectively, 100% of the gain is pushed into the §1291 machine.

- Large Dividends: Any distribution that exceeds 125% of the average distributions from the prior three years (or the holding period, if shorter).

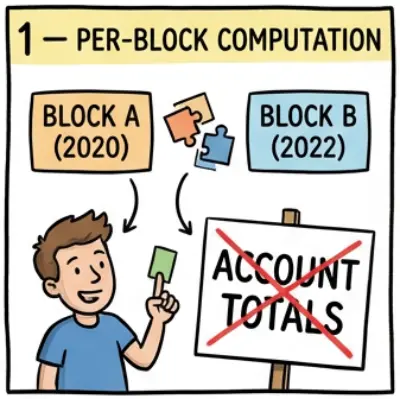

1. Per-Block Computation (Not Account Totals)

A common error is aggregating all shares into a single "average cost" bucket. IRC §1291(b)(3)(A) strictly mandates that determinations be made on a share-by-share basis.

You may only aggregate shares into a "Block" if they have the exact same holding period.

- Block A: 100 shares bought Jan 1, 2020.

- Block B: 50 shares bought Mar 15, 2021 (e.g., via dividend reinvestment).

When a distribution arrives, it must be allocated pro-rata to Block A and Block B. Block B has a shorter holding period and a different 3-year history. Mixing these inputs invalidates the Line 16a calculation.

2. “Only Amounts Already Included in Income” Rule

The 3-year average (Line 15b) is not simply "total cash received." It is strictly the sum of amounts actually included in gross income in prior years.

- Allocations to pre-PFIC years (income) count toward future averages.

- Allocations to PFIC years (taxed under §1291) do NOT count as "included in income" for this specific test (per §1291(b)(3)(C) logic).

This creates a recursive data requirement: to calculate this year's threshold, you must know exactly how much of last year's dividend was treated as "excess" versus "ordinary."

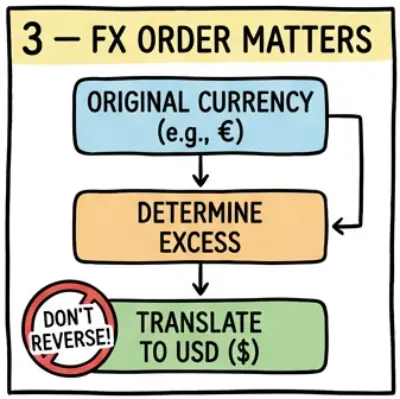

3. Foreign-Currency Determinations (Order Matters)

IRC §1291(b)(3)(E):

“If the distributions are received in a foreign currency, determinations under this subsection shall be made in such currency...”

The sequence is non-negotiable:

- Calculate in Foreign Currency: Perform the 125% test using the original currency (e.g., EUR or JPY).

- Identify Excess: Determine the specific amount of excess distribution in that foreign currency.

- Translate to USD: Only then translate the excess portion into USD using the spot rate on the distribution date.

4. Historic Rates and §6621 Interest

4.1 Highest Rate of Tax per Year

Amounts allocated to prior years are taxed at the highest marginal rate for that year (e.g., 39.6%, 37%), regardless of your actual income that year. You cannot use your lower effective rate.

4.2 Daily Compounded Interest

Interest is calculated under IRC §6621. It runs daily from the due date of the prior year's return to the due date of the current return.

- Rates change quarterly.

- Compounding is daily.

- No shortcut: You must compute interest separately for every historic year touched by the allocation.

5. Accuracy Checklist (Form 8621 Part V)

Before finalizing Line 16a, verify these points against your workpapers:

- ✅ Per-block method: Lines 15b–15e are computed separately for each lot.

- ✅ Income-only average: Excluded prior "excess" amounts from the 3-year average test.

- ✅ Currency order: 125% test performed in original currency first.

- ✅ Historic highest rate: Used the statutory top rate for each specific prior year.

- ✅ §6621 interest: Applied specific quarterly rates with daily compounding.

📥 Form 8621 §1291 Workpapers Sample

Line 16a is not a single number—it requires a full attached schedule. Download a real, anonymized example of audit-grade workpapers generated by our engine.

Includes:

- 16a_Excess_Distribution: Per-lot, per-year allocation schedules.

- 16a_Disposition: FIFO gain mapping and §1291 tax calculation.

- Interest_Log: Daily §6621 interest proofs.