PFIC §1291 Interest Calculation for Form 8621 — Due Date Rules & Daily Compounding

Last updated: Nov 2025

A critical error in PFIC interest calculation is using the extended filing date (e.g., October 15). IRC §1291(c)(3)(B) explicitly requires interest to be calculated from the original statutory due date (generally April 15), determined without regard to extensions. Using the wrong date can result in significant interest understatements.

A practitioner-focused guide to the mechanics of IRC §1291(c)(3), §6601, §6621, §6622, and §7503 — explaining how statutory due dates determine interest periods, why extensions are ignored, and how daily compounding is applied for Form 8621 reporting.

This article focuses specifically on the interest period mechanics under §1291(c)(3). For the full PFIC §1291 computational flow — including the 125% test, excess distribution allocation, block segmentation, and complete Form 8621 workpapers — see the companion article PFIC §1291 Excess Distribution — Professional Case Study & Form 8621 Computational Framework .

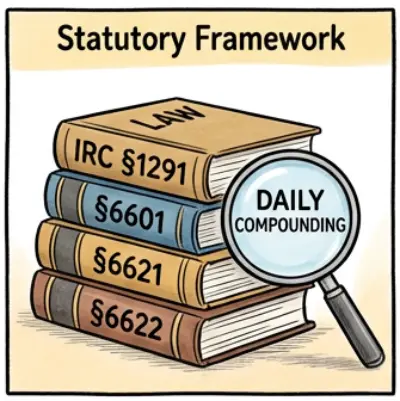

1. Statutory Framework

The PFIC interest charge is defined by several interacting sections of the Internal Revenue Code. When a PFIC excess distribution is allocated to prior years, the deferred tax must be increased by interest computed under:

- IRC §1291(c)(3)(A): Defines the start and end of the interest period.

- IRC §1291(c)(3)(B): Defines “due date” — ignoring extensions.

- IRC §6601 & §6621: Underpayment interest rules and quarterly IRS rates.

- IRC §6622: Daily compounding requirement.

2. What “Due Date” Means Under §1291

A common mistake is using the taxpayer’s actual filing deadline (e.g., October 15 with Form 4868). This is incorrect under §1291.

§1291(c)(3)(B) clearly states: “‘Due date’ means the date prescribed for filing the return determined without regard to extensions.”

For calendar-year individual taxpayers, the baseline due date is:

- April 15, unless modified by §7503 (weekend or DC holiday).

Note: Fiscal-year entities and corporations may have different unextended due dates (e.g., March 15 for S-corporations). The mechanics remain identical, but this article assumes individual calendar-year taxpayers.

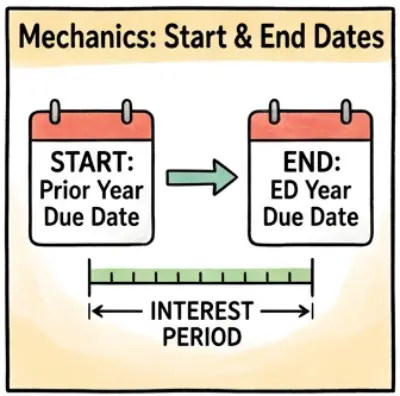

3. Mechanics of the Interest Period

The PFIC interest calculation requires determining two statutory dates for each allocated year:

Start Date — Prior-Year Statutory Due Date

This is the due date of the return for the year to which income is allocated. For example:

- Allocated Year 2023 → Start Date = April 15, 2024 (A normal 4/15 year, before applying §7503 adjustments.)

End Date — Excess Distribution Year’s Due Date

If the excess distribution occurs in 2024:

- End Date = April 15, 2025

4. The Weekend Rule & Emancipation Day (IRC §7503)

The statutory due date may shift when April 15 is:

- a Saturday or Sunday, or

- a District of Columbia legal holiday (e.g., Emancipation Day on April 16).

Under IRC §7503, if the due date falls on any of these days, the statutory due date is postponed to the next business day.

Many generic software tools hard-code every year as “4/15,” which can understate or overstate interest by several days per allocated year. Audit-ready PFIC workpapers must apply §7503 precisely.

5. Illustrated Example: 2024 Excess Distribution

Assume a calendar-year individual taxpayer receives an excess distribution in 2024. The statutory due date for the 2024 return is April 15, 2025.

The table below shows the correct statutory start and end dates for the allocated years:

| Allocated Year | Start Date (Statutory Due Date) |

Approx. Days | Authority |

|---|---|---|---|

| 2019 | 2020-07-15 | 1,735 | Notice 2020-23 (COVID) |

| 2020 | 2021-05-17 | 1,429 | Notice 2021-21 (COVID) |

| 2021 | 2022-04-18 | 1,093 | §7503 (Emancipation Day) |

| 2022 | 2023-04-18 | 728 | §7503 (Emancipation Day) |

| 2023 | 2024-04-15 | 365 | Standard §1291 |

6. §6621 Rates & §6622 Daily Compounding

Once the statutory period is defined, the PFIC interest computation is performed under the IRS underpayment rules:

- Divide the interest period into quarterly segments based on IRS Revenue Rulings.

- Apply §6621(a)(2) Underpayment rate = Federal short-term rate + 3%.

- Apply §6622 daily compounding PFIC interest is compounded daily across all applicable rate periods.

A 10-year PFIC allocation may involve over 40 distinct interest segments joined into a single liability.

7. Practical Takeaways for CPAs & EAs

In real practice, PFIC §1291 interest is difficult not because the rules are unclear, but because every component changes year by year or quarter by quarter.

- Start dates differ for every allocated year — sometimes April 15, sometimes shifted by IRC §7503 (weekends / Emancipation Day), and in recent years affected by COVID postponement notices.

- Interest rates change every quarter under §6621, and must be applied with daily compounding under §6622.

When a PFIC has been held for 10–20 years, these shifting statutory dates and quarterly rates combine to produce dozens of interest segments. A fully compliant §1291(c)(3) calculation that matches IRS mechanics is virtually impossible to maintain reliably in Excel.

For a deeper technical walk-through — including the 125% test, block segmentation, excess-distribution allocation, and how interest flows into Form 8621 workpapers — see the companion case study:

PFIC §1291 Excess Distribution — Professional Case Study & Form 8621 Computational Framework

And for a broader discussion of why spreadsheets consistently break down when attempting §1291 calculations, including the four structural failure points, refer to:

Why Excel Fails for PFIC §1291 — The Four Levels of Breakdown

If your goal is to avoid rebuilding §1291 and §6621/§6622 logic manually, the pfic.xyz PFIC Calculator was designed specifically for EAs and CPAs: upload a clean CSV, and it produces audit-ready §1291 and §1296 Form 8621 workpapers automatically.