PFIC §1291 Excess Distribution — Professional Case Study & Form 8621 Computational Framework

A practitioner-focused walkthrough demonstrating how the §1291 excess-distribution rules actually operate—covering the 125% test, holding-period determination, day-weighted allocation, includable income tracking, and §6621 interest calculations.

1 — Why This Case Study Matters for Form 8621 Prep

Section 1291 often feels counterintuitive—not because tax professionals lack expertise, but because the statute intentionally re-characterizes timing: current-year PFIC cash flow must be decomposed, traced backwards, and taxed as if earned in prior years.

To demonstrate how this reconstruction actually works in practice for Form 8621, we use a clean, fact-driven case study with a single PFIC acquisition and one large distribution. This provides the minimum dataset required to expose every step behind a defensible §1291 excess-distribution computation.

2 — Example Scenario: One PFIC Holding

Taxpayer: U.S. person, no QEF or MTM elections made.

Initial acquisition: 2019-09-05 — one single PFIC block purchased.

Tax year filed: 2024.

Key event: A large $2,000 distribution received on 2024-05-05.

The PFIC transaction table on the right is a teaching ledger — a simplified, modelled dataset built solely to demonstrate the §1291 mechanics (the 125% excess distribution test, holding-period allocation, and interest calculation). Under the statute, only the distributions from 2021, 2022, and 2023 enter the §1291 125% excess distribution test; earlier dividends remain part of the timeline but are excluded from the threshold calculation.

| Date | Details | Units | Value |

|---|---|---|---|

| 2019-09-05 | Purchase | 1000 | 10000 |

| 2019-10-15 | Dividend | 0 | 70 |

| 2020-06-15 | Dividend | 0 | 80 |

| 2021-06-15 | Dividend | 0 | 90 |

| 2022-06-15 | Dividend | 0 | 100 |

| 2023-06-15 | Dividend | 0 | 110 |

| 2024-05-05 | Dividend | 0 | 2000 |

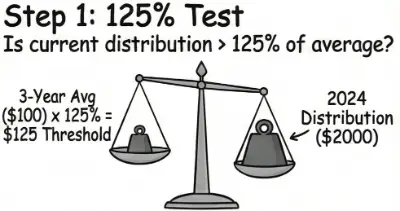

3 — Step 1: The 125% Excess Distribution Test Calculation

The first step in preparing Form 8621 Part V is determining if the current year distribution exceeds the statutory threshold.

125% threshold (Line 15d) = 100 × 1.25 = 125

Breakdown of the $2,000 distribution received in 2024:

- $125 — ordinary income (non-excess portion, Line 15e)

- $1,875 → excess distribution under §1291 (Line 15f)

4 — Step 2: Holding-Period Calculation & Daily Allocation Method

Under §1291, the excess portion ($1,875) is not assigned evenly by tax year — it must be allocated strictly by days held. This is a frequent source of calculation errors.

Holding period determination: 2019-09-05 → 2024-05-05.

Total days held: 1,704

⚠️ Crucial Practitioner Note: Counting both the acquisition and distribution dates yields

1,705 days, which is incorrect under IRC §1223 principles. The holding period begins the day after acquisition. This precise day count drives the entire allocation percentage.

• IRC §1223 — holding period begins the day after acquisition.

• §1291(c)(1)(A) — excess distributions are allocated over each day the PFIC stock was held, including the distribution date.

Daily excess distribution amount: $1,875 ÷ 1,704 days ≈ $1.10035 per day

| Year | Days Held | Excess per Day | Allocation % | Allocated Excess (Form 8621 Line 16) | Tax Treatment |

|---|---|---|---|---|---|

| 2019 | 117 | $1.10035 | 6.9% | $128.74 | Prior year (Throwback) |

| 2020 | 366 | $1.10035 | 21.5% | $402.73 | Prior year (Throwback) |

| 2021 | 365 | $1.10035 | 21.4% | $401.63 | Prior year (Throwback) |

| 2022 | 365 | $1.10035 | 21.4% | $401.63 | Prior year (Throwback) |

| 2023 | 365 | $1.10035 | 21.4% | $401.63 | Prior year (Throwback) |

| 2024 | 126 | $1.10035 | 7.4% | $138.64 | Current year (Ordinary Income) |

| 2024 | — | — | — | $125.00 | Current year (Non-excess) |

| Total | 1,704 days | $1.10035/day | 100% | $1,875.00 |

Critical Error: Using Raw Cash for Next Year’s Form 8621 Line 15b Baseline

A common and expensive mistake is using the raw distribution amount for future calculations. Only the portion of the 2024 distribution that is actually included in 2024 taxable income flows into the next year’s three-year baseline (Line 15b).

The remainder—allocated to prior years and subject to §6621 interest—is not treated as a 2024 distribution and is therefore strictly prohibited from being included in the baseline for future years.

| 2024 Amount | Source | Included in 2024 Income? | Included in Future 125% Baseline? |

|---|---|---|---|

| $125.00 | Non-excess distribution (Line 15e) | ✅ Yes | ✅ Yes |

| $138.64 | Current-year portion of excess distribution | ✅ Yes | ✅ Yes |

| $1,736.36 | Prior-year allocated excess (subject to top rate + §6621 interest) |

❌ No | ❌ No |

| $263.64 | Total includable PFIC income for 2024 baseline | ✅ Yes | ✅ Yes |

Therefore, when performing the 2025 §1291 excess-distribution test, the correct three-year baseline must be:

| Year | Incorrect Method (uses raw cash received) |

Correct Method (uses only includable income) |

|---|---|---|

| 2022 | $100 ✅ | $100 ✅ |

| 2023 | $110 ✅ | $110 ✅ |

| 2024 Baseline | $2,000 ❌ (Wrong) | $263.64 ✅ (Correct) |

| Line 15b — Total | $2,210.00 ❌ | $473.64 ✅ |

| Line 15c — 3-year average | $736.67 ❌ | $157.88 ✅ |

| Line 15d — 125% threshold | $920.83 ❌ | $197.35 ✅ |

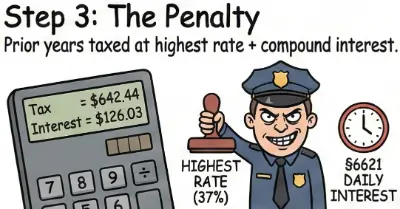

5 — Step 3: Highest Marginal Tax Rates & §6621 Interest Calculation

The "throwback" amounts allocated to prior years are not taxed at the taxpayer's actual historical rate. Instead, §1291 mandates the use of:

- The highest federal marginal income tax rate applicable for that specific prior year (e.g., 37% for individuals in recent years), AND

- Mandatory interest under IRC §6621, compounded daily from the due date of the prior year's return.

This is why §1291 liabilities frequently exceed the income itself — the tax is only the starting point, and the accumulated §6621 interest penalty can be substantial.

| Year | Allocated Amount (from Step 2) | Mandatory Top Rate | Tax Liability | §6621 Interest (Daily Compounded) | Total Due per Year |

|---|---|---|---|---|---|

| 2019 | $128.74 | 37% | $47.63 | $14.96 | $62.59 |

| 2020 | $402.73 | 37% | $149.01 | $40.23 | $189.24 |

| 2021 | $401.63 | 37% | $148.60 | $34.47 | $183.07 |

| 2022 | $401.63 | 37% | $148.60 | $24.48 | $173.08 |

| 2023 | $401.63 | 37% | $148.60 | $11.89 | $160.49 |

| Total Form 8621 Liability for this Distribution | $642.44 | $126.03 | $768.47 | ||

6 — Why Real-World PFIC Cases Are Exponentially Harder

The case study above models the easiest possible PFIC scenario: one single purchase block and one distribution per year. There were no additional buys, no dividend reinvestments (DRIPs), no partial sales, and no multi-currency issues.

Real PFIC accounts rarely look like this. Once a taxpayer dollar-cost averages, reinvests dividends monthly, or sells only part of a position, **§1291 calculations must be performed separately for every single tax lot (block)**.

Consider a standard mutual fund where dividends are reinvested monthly for 10 years. That single holding creates:

- 1 original acquisition block

- + 120 new monthly reinvestment blocks (each with its own holding period start date)

- = 121 distinct tax lots requiring individual tracking.

When a subsequent excess distribution occurs, the §1291 engine must compute 121 separate daily holding period allocations, track 121 separate includable income histories for future baselines, and calculate interest on 121 separate schedules. This is why manual Excel spreadsheets fail for real-world PFICs.

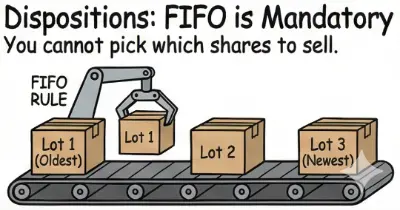

7 — Beyond Distributions: FIFO Ordering on PFIC Dispositions

Disposing of a PFIC via sale or redemption is mechanically different than analyzing a dividend. Under **IRC §1291(a)(2)**, the entire gain realized on the disposition is treated as an excess distribution. The 125% threshold test does not apply to dispositions.

Crucially, the regulations require strict **First-In, First-Out (FIFO)** ordering (Treas. Reg. §1.1291-1(b)(7)(ii)) to determine which blocks are sold. You cannot use specific identification. Once multiple lots exist, accurately tracking gains, holding periods, and basis under mandatory FIFO in Excel becomes unmanageable.

For a deeper dive into why spreadsheets break down under these conditions, read:

Why Excel Fails for PFIC §1291 — The Four Levels of Breakdown →