QEF vs MTM vs §1291 — Where a PFIC Calculator Actually Helps

A practitioner's guide to navigating PFIC elections, managing "late" transitions, and automating the complex math behind Form 8621.

This article is written for EAs, CPAs, and cross-border tax practitioners who already know what a PFIC is.

The goal is not to re-explain the basics of Qualified Electing Fund (QEF) or Mark-to-Market (MTM), but to answer a narrower, practical question:

in a world of QEF, MTM, and default §1291, where does a dedicated PFIC calculator like pfic.xyz actually add value?

1. Audience and Scope

This note assumes you already work with Form 8621 and are comfortable with the concepts of:

- PFIC default treatment under IRC §1291,

- the QEF election under §1295, and

- the MTM election for “marketable stock” under §1296.

The focus here is on election strategy plus workflow:

when QEF is theoretically available but impractical, when MTM is the only realistic alternative, why §1291 still drives most of the heavy lifting,

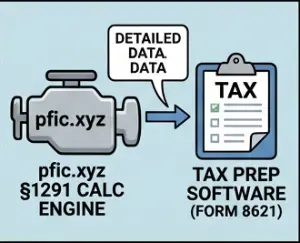

and how pfic.xyz plugs into that picture as a calculation engine rather than a “push-button election wizard”.

2. Where QEF Fits (And Where It Doesn’t)

On paper, QEF is often the “cleanest” long-term answer: current inclusion of ordinary income and net capital gain, basis adjustments, and potential capital-gain treatment on exit. In practice, most retail PFICs held by U.S. expats do not issue a usable PFIC Annual Information Statement (AIS), which makes a compliant QEF election impossible or uneconomic to maintain.

Where QEF does appear in real files is usually one of three patterns:

- Specific fund families in Canada, the UK, or Europe that deliberately support U.S. investors with AIS reporting.

- Private funds or CFC structures where the AIS is effectively a side-product of audited financials.

- “Late” QEF elections where one or more prior years have already fallen under §1291 and now need to be purged.

It is this last case—QEF with a history of §1291 years—where a calculator like pfic.xyz starts to matter.

Making a "late" QEF election requires purging prior §1291 "taint," a complex calculation that a dedicated engine can handle.

3. Where MTM Fits

The MTM election under §1296 is narrower in concept but broader in availability: you do not need AIS, you “only” need marketable stock—PFIC shares traded on a qualified exchange with reliable year-end pricing. For many expats holding local ETFs, listed funds, and certain exchange-traded notes, MTM is the only realistic election in town.

From a computational perspective, MTM replaces a single “big §1291 event” at disposal with a stream of annual ordinary income (and limited ordinary loss).

But if there are one or more pre-election §1291 years, you still have to:

- run a deemed-sale purging computation for the historic gain up to the MTM start date, and

- track the carryforward of prior MTM gains and losses going forward.

This again is calculator territory rather than spreadsheet comfort-zone.

How to Purge PFIC §1291 Taint – Deemed Sale, MTM Transition & Form 8621

4. Why §1291 Remains the Computational Core

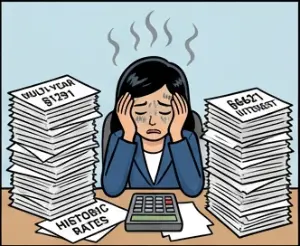

Regardless of what you prefer conceptually—QEF or MTM—the hardest work you will ever do with PFICs tends to be:

- multi-year §1291 blocks with irregular distributions and partial disposals,

- late QEF or late MTM elections that require purging prior §1291 years, and

- hybrid histories where a PFIC transitions between regimes or has “holes” in reporting.

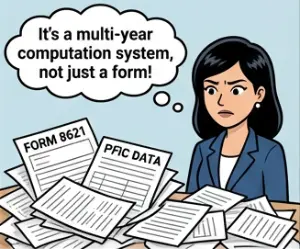

Commercial tax software can usually file Form 8621 once you know the answers, but it does not run block-level excess distribution mechanics, year-by-year allocation at historic highest rates, or §6621 interest on deferred tax across dozens of years.

That is the gap pfic.xyz is designed to fill: it is a calculation engine for §1291 and MTM, not a front-end election switch.

5. QEF vs MTM: Purging and Taint Cleansing

Both QEF and MTM require you to deal with any prior §1291 “taint” if the election is not effective from day one. Conceptually you have two cleansing routes in the regulations, but only one is normally usable in a retail PFIC environment:

| Dimension | QEF Cleansing (with Purging) | MTM Cleansing (with Purging) |

|---|---|---|

| Legal basis | QEF under IRC §1295 with a purging election under Treas. Reg. §1.1291-9 or §1.1291-10 | MTM under IRC §1296 with a purging election under Treas. Reg. §1.1291-10 |

| Purging mechanism in practice | Typically a deemed sale at FMV on the qualification date. | Always a deemed sale at FMV before the MTM election becomes effective. |

| What the purging computation does | Treats the entire unrealized gain up to the purging date as an excess distribution: allocated across the holding period, taxed at historic highest rates, and subjected to §6621 interest. | |

| What pfic.xyz can model | Deemed-sale purging only (virtual FMV disposal). | Same: deemed-sale purging only. |

In other words: in practice, “purging” almost always means modelling a deemed sale at FMV, and that is exactly the scenario that pfic.xyz is built to support.

6. What pfic.xyz Actually Does in a QEF Context

If you have a true QEF scenario with a continuous AIS and no prior §1291 years, you do not need a §1291 calculator at all. The QEF inclusions flow into your normal workpapers and tax software like any other pass-through item.

Where pfic.xyz becomes relevant is when QEF is “late” or incomplete. Typical EA/CPA use-cases are:

-

Late QEF election with one or more §1291 years:

you record a virtual FMV disposal (deemed sale) in the election year;

pfic.xyzcomputes the full §1291 excess distribution block. - Broken AIS history: some years have AIS and were treated as QEF; other years were effectively §1291.

- Audit or amendment scenarios: reconstructing the §1291 piece surrounding a QEF period.

7. What pfic.xyz Does for MTM and Hybrid Histories

For MTM, the difficulty spikes when an MTM election is made after several §1291 years, or when you have:

- multiple partial disposals before the MTM start date,

- reinvested distributions that affect cost basis under §1291 before the election, or

- a mix of §1291, MTM, and non-PFIC years in one holding period.

In those cases, practitioners often use pfic.xyz to run the complete §1291 history up to the deemed-sale purging date

and obtain block-level Excel workpapers.

8. Regime Comparison with Calculator Relevance

The three regimes can be summarised as follows, with an explicit view on where a dedicated PFIC calculator is actually useful:

| Dimension | QEF Election | MTM Election | Default §1291 |

|---|---|---|---|

| When a PFIC calculator is most relevant | Late QEF elections and hybrid histories where prior §1291 years must be purged. | Late MTM elections with prior §1291 years, or complex pre-election histories. | Almost all non-trivial cases: multi-year holdings, reinvestments, partial sales. |

| Typical role of pfic.xyz | Compute the purging §1291 block. | Same: compute the purging §1291 block. | Serve as the primary computation engine for excess distributions and interest. |

9. How to Model a Deemed-Sale Purging Year in pfic.xyz

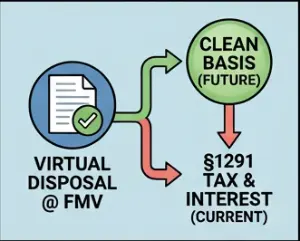

Conceptually, a deemed-sale purging election treats the PFIC as if it were fully sold at FMV immediately before the new regime (QEF or MTM) begins.

In pfic.xyz, that is implemented by adding one virtual disposal line to the CSV:

- Choose the purging year.

- Insert a transaction dated near the end of that year (e.g., 31 December).

- Classify it as a full disposal of the remaining units at that date.

- Set the proceeds equal to the FMV on the purging date.

- Run the calculator in §1291 mode for that PFIC.

The tool will treat that event as a normal §1291 disposal, perform the excess distribution allocation, apply historic highest rates, compute §6621 interest, and output audit-ready workpapers. You then use the post-purging FMV as the starting basis for QEF or MTM going forward.

10. A Practitioner’s Decision View

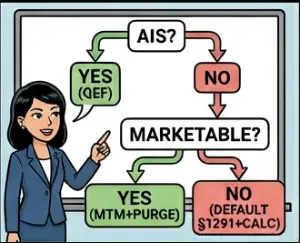

For each PFIC, a realistic workflow for EAs and CPAs tends to look like this:

-

Step 1 — Check for AIS:

if the fund provides a compliant AIS, QEF is on the table.

If late, use

pfic.xyzfor the purging §1291 block. -

Step 2 — If no AIS, check marketability:

if listed, MTM is on the table.

If late, use

pfic.xyzfor the deemed-sale purge. - Step 3 — If neither condition holds: the PFIC remains under default §1291. A dedicated calculator is the only practical way to produce workpapers.