Can PFIC Gains and Losses Be Netted? — The §1291 Multi-Lot Disposition Trap

Netting is legally impossible because §1291 places gains and losses in two mutually exclusive tax regimes.

* Note: While the Proposed Regulations (1992) are not finalized, they represent the only available official interpretive guidance for §1291 loss treatment.

The Verdict: You are legally required to bifurcate the transaction. Gains are reported on Form 8621, Part V, Line 15f; Losses must be moved to Schedule D.

Why computing an "economic net result" is the #1 PFIC netting error, and how §1291 segregates gains from losses at the lot level.

This article addresses PFIC gain netting errors, PFIC loss treatment under §1291, lot-level segregation, and why Form 8621 cannot accept disposition-level netting.

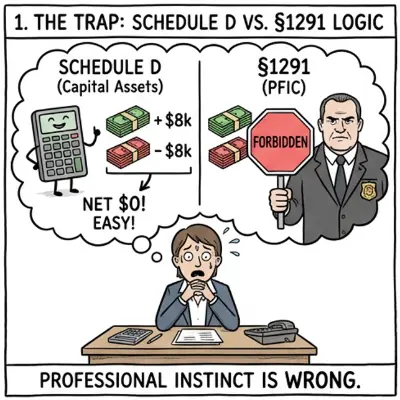

1. The "Schedule D" Trap (Unlearning Your Instincts)

Every Junior Associate is trained on the fundamental logic of capital assets: Capital Gains minus Capital Losses equals Net Capital Gain.

When you receive a brokerage statement showing 60 transactions, your instinct is to drop them into Excel and compute an economic net result.

However, §1291 is not a capital gains regime. It is a punitive anti-deferral regime.

- Schedule D Logic: "I made $8k here, lost $8k there. Net result is zero."

- §1291 Logic: "You made $8k? Pay max tax and interest on that immediately. You lost $8k? That's a separate problem for Schedule D."

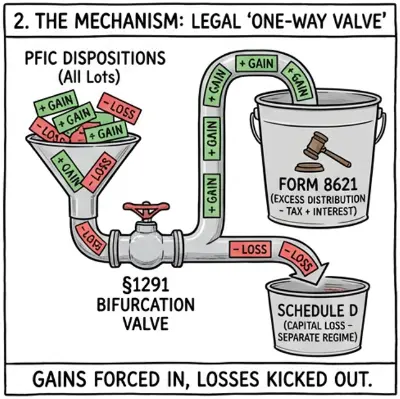

2. Why §1291 Forbids Netting — The Regulatory “One-Way” Valve

Why does this happen? It stems from how the statute defines "Excess Distributions."

2.1 The Gain Side (Form 8621)

Under 26 U.S.C. §1291(a)(2), any gain recognized on a specific share is treated as an Excess Distribution. This gain is fully taxed under §1291 mechanics even if the overall fund shows a loss.

2.2 The Loss Side (No Negative Excess)

Crucially, §1291 does not recognize "negative excess distributions." If you sell a share at a loss:

- The loss does not reduce the "Excess Distribution" calculated for profitable shares.

- The loss does not reduce the §6621 interest charge.

- The loss is recognized under general tax principles as a Capital Loss.

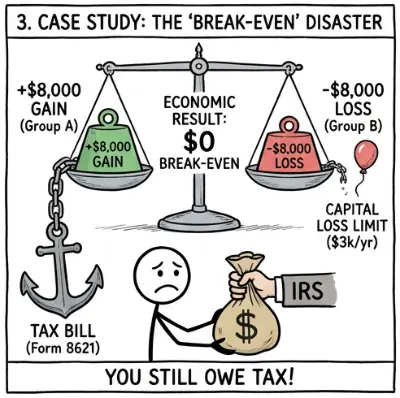

3. Case Study: The "Break-Even" Disaster

This example illustrates mandatory lot-level segregation under §1291 — gains must enter the excess-distribution mechanism, while losses are diverted to capital-loss treatment.

The Fact Pattern

(Illustrative amounts chosen for clarity)

- Structure: 60 Separate Tax Lots (Monthly contributions over 5 years).

- Action: Sold 100% of the fund (FIFO Disposition).

- Total Cost Basis: $60,000

- Total Proceeds: $60,000

- Client's Economic Reality: "I broke even. Zero profit, zero tax."

- PFIC Calculator (pfic.xyz) verdict: $8,000 is a §1291 gain (Form 8621)

| Lot Group | Performance | Economic Result | Tax Treatment (The Split) |

|---|---|---|---|

|

Group A (25 Lots) Acquired at Low NAV |

Profitable | +$8,000 Gain |

⚠ Taxable under §1291 Recognized as Excess Distribution. Must pay max tax + interest immediately. Report on: Form 8621, Part V, Line 15f |

|

Group B (35 Lots) Acquired at High NAV |

Loss | -$8,000 Loss |

⚠ Capital Loss Only Cannot offset Group A's gain. Restricted to $3,000/year deduction. Report on: Schedule D / Form 8949 |

| NET TOTAL | BREAK-EVEN | $0 |

Result: Client owes tax on $8,000 gain + Interest. Economic Loss: Client loses money after paying the tax. |

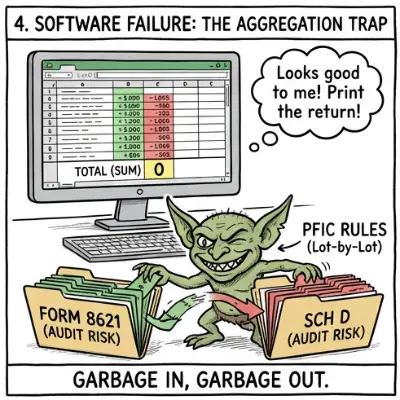

4. Why Excel & Tax Software Lie to You

Why is this PFIC netting error so common? Because your tools encourage it.

The Excel Aggregation Problem

Excel aggregates by rows; §1291 applies rules by lots.

If you `SUM()` the Gain/Loss column, Excel effectively treats the tax regime as uniform. It does not know that Row 25 (Gain) must go to Form 8621 while Row 26 (Loss) must go to Schedule D.

The Commercial Software Gap

Software like CCH Axcess or Lacerte often treats Form 8621 as a simple input form. If you manually net the numbers outside the software and enter 0, the software will not stop you. It will generate a valid-looking, but legally incorrect, return.

5. Constructing Audit-Ready Workpapers

The Compliant Workflow:

- Strict Lot Tracking: Maintain a permanent record of every tax lot (FIFO or Specific ID). Do not rely on average cost.

- Bifurcation: Sort the disposition rows. Positive results ("Gainers") stay in the §1291 calculation; negative results ("Losers") must be excluded.

- Dual Reporting:

- Route the Gains to the §1291 interest engine (Form 8621).

- Route the Losses to Schedule D (Capital Loss).

- Detailed Attachment: Your PDF attachment to Form 8621 should clearly show this separation to prevent IRS inquiries about the discrepancy.

Download Case Study Workpapers (Excel)

(See how the $8,000 gain and $8,000 loss are separated in the final output)