How to File Form 8621 Yourself – A Practical DIY PFIC Guide

Last updated: Nov 2025

For small PFIC accounts, cost-sensitive taxpayers, and detail-oriented DIY filers

Are You Googling Things Like…

- “How to file Form 8621 by myself”

- “DIY PFIC calculation guide”

- “Do I really have to file PFIC for a small account?”

- “Is there a free PFIC calculator or Excel template?”

If so, you’re in the same situation as many U.S. investors with foreign funds: the account balance is relatively small, but PFIC Form 8621 quotes come back at $150–$600 per PFIC.

That naturally leads to three questions:

- ✅ Can I file PFIC and Form 8621 myself?

- ✅ How hard is it in practice?

- ✅ Is there a realistic way to keep costs down without cutting corners?

This article is written specifically for DIY-minded taxpayers. We’ll cover:

- whether you actually have to file Form 8621

- where the real difficulty lies (it’s not just “filling a form”)

- whether DIY is realistic for you

- what parts must still be your responsibility

- and how pfic.xyz can handle expert-level calculations once you provide a clean transaction CSV

1. Do You Really Have to File Form 8621 for a Small PFIC?

A very common misunderstanding is:

“If my PFIC balance is under $25,000, I don’t need to file Form 8621.”

For most real-world situations, that is wrong.

The key trigger is not account size, but events.

Once any of the following happens:

- the PFIC pays a distribution (dividend or similar), or

- you dispose of shares (full or partial sale), or

- you reinvest a dividend into new PFIC shares (DRIP),

you are generally looking at a Form 8621 filing requirement, even if the account is “small” in your mind.

There is no “tiny dividend” exception that makes the whole PFIC disappear. A $10 distribution can still trigger PFIC reporting.

If you want a deeper dive into why even small accounts generate

large fees, see:

Why Are PFIC Form 8621 Fees So High? — Complexity vs. Account Size

2. Where DIY PFIC Filing Is Actually Hard

On paper, Form 8621 looks like “just another IRS form”. In reality, PFIC is a multi-year calculation system with memory. The hard part is not typing numbers into boxes — it’s getting those numbers right with correct PFIC calculations under §1291 and §1296.

The main technical pain points are:

📌 2.1 §1291 Excess Distribution “Look-Back”

- Each distribution must be tested under the 125% excess distribution rule.

- If there is excess, it must be allocated across all prior holding years.

- For each prior year, you compute “deferred tax” and then apply daily-compounded interest (under §6621).

This is already painful for one PFIC, one year. It gets much worse when:

- there are many small reinvested dividends

- or the holding period spans 10+ years

📌 2.2 Lot-Level Accounting (Every Purchase Is a Separate Lot)

- Each buy (including reinvested dividends) is its own lot.

- Each lot has:

- its own basis in USD

- its own acquisition date

- its own holding period

- its own role in future disposals or MTM calculations

Over many years with regular reinvestment, you can easily end up with 100–300 separate lots that must all be tracked correctly in your PFIC Excel model or in a dedicated PFIC calculator.

📌 2.3 Partial Dispositions and FIFO

If you sell only part of a PFIC position, the default rule is usually FIFO (First-In, First-Out), unless you have very strong documentation for specific-lot identification.

- Multiple old lots may be consumed in a single sale.

- You must proportionally reduce:

- units in each lot,

- adjusted basis per lot, and

- any unreversed inclusions (UNI) where relevant.

- Those changes affect every future year’s calculations.

Most Excel power users reach a dead end when facing partial redemptions under FIFO; the logic collapses, and they are forced to give up. See the detailed breakdown in Why Excel Fails for PFIC §1291 — The Four Levels of Breakdown .

For a time-based breakdown of how long PFIC really takes, see:

How Long Does a PFIC Form 8621 Filing Really Take?

3. Is It Legally Allowed to File PFIC Yourself?

Yes. Legally, you can file PFIC yourself.

- The IRS does not require a CPA or EA for Form 8621.

- Any individual taxpayer can, in theory, prepare their own PFIC calculations and file Form 8621.

However, there is a big difference between “legally allowed” and “practically realistic.” Many people start with a DIY Excel model for PFIC §1291, then stop halfway when they realize:

- the spreadsheet keeps breaking when they add more years or more lots,

- they can’t get FIFO to behave correctly, and

- they have no idea how to document the calculations for audit purposes.

This is exactly where a purpose-built PFIC engine like pfic.xyz takes over: it rebuilds the entire §1291 history from raw transactions on every run, enforces FIFO across all years and lots, and produces a complete, audit-ready computation log automatically.

4. What Parts Must Still Be Your Responsibility?

Even with automation, some tasks cannot be delegated to software. These remain your job, whether you are a DIY filer or a tax professional:

| Task | Your Responsibility | What pfic.xyz Handles |

|---|---|---|

| Data collection | Gathering statements, exports, and transaction history from brokers. | n/a — the system expects a structured CSV, not raw PDFs. |

| Data cleaning & classification | Turning broker output into a clean CSV with proper date format (YYYY-MM-DD), consistent units, and correct transaction types (e.g. dividend vs. return of capital vs. purchase). | Assumes the CSV is already clean; it will not guess transaction types. |

| Judgment calls | Deciding which holdings are PFICs, whether an election (e.g. MTM) is appropriate, and how to treat edge-case transactions. | Applies calculations based on the data and elections you provide. |

| Review & filing | Reading and understanding the outputs, deciding what to enter on Form 8621, and signing your tax return under penalty of perjury. | Produces detailed, audit-grade workpapers to support your review. |

If you are not comfortable cleaning data or understanding at least the basics of PFIC rules, DIY PFIC filing is going to be stressful and risky — with or without a calculator.

5. How pfic.xyz Makes DIY PFIC More Realistic

For an individual filer, the realistic way to handle DIY PFIC is not to compute every detail manually in Excel. A practical workflow is for you to focus on data preparation and the necessary judgment calls, while pfic.xyz handles the §1291 and MTM (§1296) calculations and produces complete, audit-ready workpapers. See the pfic.xyz User Guide for the full process.

- You prepare a clean, well-structured CSV.

- A dedicated engine handles the complex math.

- You review the outputs and decide what goes on Form 8621. The User Guide also includes downloadable sample output packages so you can see exactly what the audit-ready workpapers produced by pfic.xyz contain.

With pfic.xyz, the engine is the part that’s automated.

Once your CSV is ready, pfic.xyz can:

- run §1291 excess distribution testing across all relevant years

- compute look-back tax and interest

- apply FIFO to partial dispositions at the lot level

- track lot history, basis, and (where relevant) UNI over multiple years

- produce structured, audit-ready Excel workpapers showing all steps

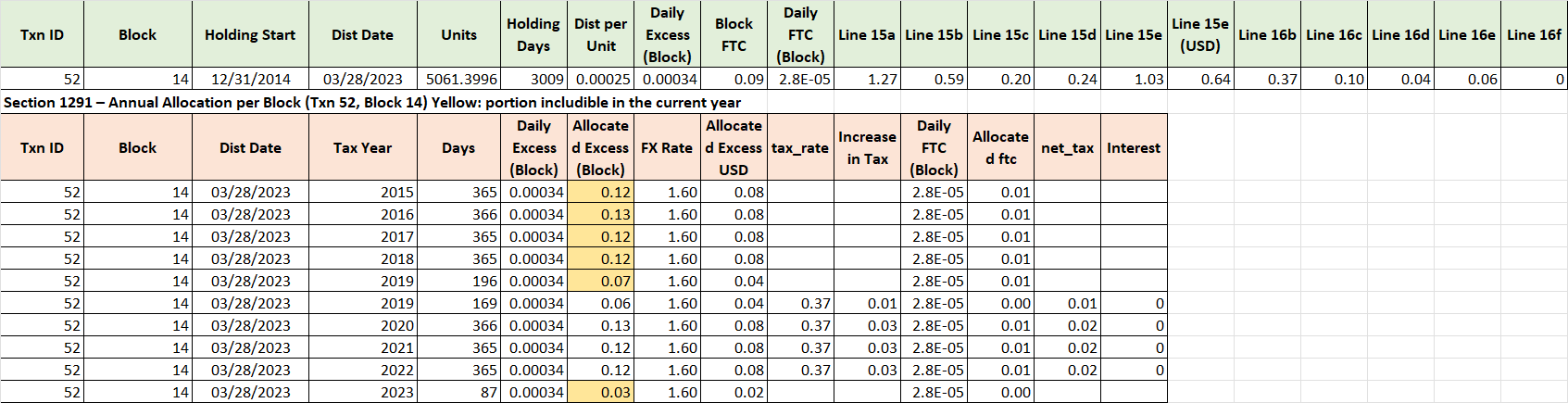

-

automatically generate the 16a schedule for §1291, including the

block-level 15b calculations —

hell-tier task

:

- 15b calculated in foreign currency — §1291(b)(3)(E)

- each block’s 15b computed separately — §1291(b)(3)(A)

- include only ordinary distributions and the current-year excess portion (exclude amounts allocated to prior years) — §1291(b)(2)(A)(ii)

- no excess in the first PFIC year — §1291(b)(2)(B)

This calculator was designed for professional use and has been used by

multiple Enrolled Agents in real filed returns for more than half a year.

If you can provide compliant transaction data according to the requirements

in the User Guide and make the correct classifications, you will obtain

expert-level PFIC calculations and audit-ready workpapers.

Review the

User Guide carefully and download the sample cases before using the system.

Typical compute time once the CSV is uploaded is about 1–5 minutes per PFIC, with a few complex cases exceeding 10 minutes.

Cost model:

One coffee ≈ one PFIC run.

You pay per PFIC calculation, not per hour.

6. Is DIY PFIC Right for You?

DIY PFIC can be realistic if:

- you are willing to spend time cleaning and structuring your data,

- you can reliably export transactions and fix basic issues (dates, signs, duplicates),

- you are comfortable reading detailed workpapers and cross-checking numbers, and

- you accept that you, not the software, are signing the return.

DIY PFIC is probably not a good idea if:

- you cannot reliably prepare a CSV with dates in

YYYY-MM-DDformat, - you do not have complete transaction records,

- you are unwilling to read and sanity-check the outputs, or

- you expect a “black box” to handle tax judgment for you.

pfic.xyz is a calculation engine. It does not replace a tax adviser and cannot take legal responsibility for your filing. What it can do is:

- give you professional-grade PFIC calculations,

- compress 6–20 hours of spreadsheet work into a short compute run, and

- generate documentation you can keep for your records or share with a preparer.

7. Common PFIC Filing Mistakes to Avoid

These are the errors that most often break DIY Form 8621 filings and Excel-based PFIC calculations:

- Ignoring reinvested dividends (DRIPs)

A DRIP is both a distribution and a new purchase lot under §1291. Treating it as “no transaction” is wrong. - Assuming small PFIC accounts don’t require Form 8621

Filing is driven by distributions and dispositions, not account size. - Using simple “FMV minus FMV” instead of true §1291 excess distribution rules

Correct PFIC calculation requires the 125% test, allocation to prior years, and look-back interest. - Not applying FIFO to partial sales

Unless specific-lot identification is strictly documented, FIFO is the default and must be modeled correctly. - Mixing multiple PFICs into one CSV

Each PFIC must be tracked separately. One Form 8621 per PFIC, one CSV per PFIC file. - Treating Return of Capital as ordinary dividends

ROC usually adjusts basis rather than being a taxable distribution, which affects both gain and UNI. - No audit trail or workpapers

Filing Form 8621 without a clear audit-ready PFIC workpaper set is high-risk if the return is ever questioned.

Avoiding these mistakes is one of the main reasons to rely on a dedicated Form 8621 calculator instead of ad hoc spreadsheets.

8. Downloads & Templates

To make DIY PFIC more realistic, you can use structured templates and examples:

-

✅ Sample PFIC 1291 CSV Template

One PFIC per file, YYYY-MM-DD dates, clear transaction types. -

✅ §1291 Workpapers (Excel)

Block-level excess distribution schedule and Line 15 mapping for Form 8621. -

✅ §1296 MTM Workpapers (Excel)

FMV-based annual MTM adjustments and Form 8621 Part IV Line mapping.

9. PFIC & Form 8621 FAQ

Do I need to file Form 8621 for a small PFIC account?

In most cases, yes. Form 8621 filing depends on events (distributions, dispositions, DRIPs), not just account size.

Is a reinvested dividend considered a PFIC distribution?

Yes. A DRIP is a distribution for §1291 purposes and creates a new purchase lot that must be tracked.

Can I calculate PFIC §1291 in Excel?

Technically possible for simple cases, but Excel tends to break once you have multi-year holdings, many lots, partial sales, and look-back interest. That’s why many professionals use a dedicated PFIC calculator.

Do I need a CPA or EA to file Form 8621?

No. Legally, any U.S. taxpayer can file Form 8621 and perform the PFIC calculations, even for complex §1291 excess distributions.

How long does a PFIC Form 8621 filing take?

Manual spreadsheet-based PFIC work can easily take 6–20 hours. With a clean PFIC CSV and a dedicated engine, the actual §1291/§1296 calculations usually run in minutes.

Is pfic.xyz a tax adviser?

No. pfic.xyz is a PFIC calculation engine. It does not provide tax advice and cannot sign your return. It produces detailed workpapers that you (or your adviser) can use to complete Form 8621.

10. A Sensible Action Plan

-

Confirm you actually have a PFIC issue.

If you own foreign mutual funds, ETFs, or certain insurance-type products, assume PFIC is likely and check with a professional if in doubt. -

Export and clean your data.

Aim for a single CSV per PFIC, with:- dates in

YYYY-MM-DDformat, - clear transaction types, and

- amounts and units that reconcile to your statements.

- dates in

-

Run a test calculation with pfic.xyz.

Treat it as a low-risk experiment — roughly the cost of a coffee to see whether the workflow feels manageable. -

Review the outputs carefully.

Compare the summaries to your expectations, look at the detailed schedules, and decide whether you’re comfortable relying on them for filing. -

Decide on DIY vs. professional support.

You can:- file yourself using the outputs, or

- hand the workpapers to a CPA/EA and pay them to review and file.

11. Try a Real Form 8621 Calculation

If you want to see what a full PFIC §1291 calculation actually looks like in practice, you can upload one PFIC CSV and run a real calculation on pfic.xyz.

You’ll receive:

- Form 8621-ready numbers for excess distributions and dispositions,

- lot-level FIFO history and basis tracking,

- block-level 15b / 16a workpapers, and

- Excel schedules you can keep as an audit-ready PFIC file.

Pricing model: one coffee ≈ one PFIC run.

Bottom Line

Yes, you can legally file Form 8621 yourself. But you should treat PFIC as a high-risk, highly technical area of tax law — the kind that many professionals try to avoid, not a simple checkbox form.

If you are careful with data, willing to learn, and comfortable taking responsibility for the final return, then using a dedicated engine like pfic.xyz can make DIY PFIC filing realistically achievable, even for small accounts where full CPA pricing feels disproportionate.