1. Who Should Use This MTM Guide

Use this guide if:

- The PFIC is marketable stock and a valid MTM (§1296) election has been made.

- You need to compute annual FMV-based ordinary income or loss for Form 8621 Part IV.

- You are tracking Unreversed Net MTM Income (UNI) and basis adjustments over multiple years.

If there is no MTM or QEF election and you are under the default regime, please use the Section 1291 User Guide instead.

2. Prepare the CSV Transaction File (MTM) Download MTM (§1296) Example (CSV)

Prepare one CSV UTF-8 file per PFIC.

Do not combine multiple PFIC holdings in a single file — this calculator is designed to process only one PFIC at a time.

Required columns (must match exactly):

- Date — YYYY-MM-DD

- Details — text only; must not contain commas, quotes, or line breaks

- Units — numeric only; no thousands separators

-

Value —

numeric only; no thousands separators or currency symbols

(Total amount in the original currency)

| Date | Details | Units | Value |

|---|---|---|---|

| 5/03/2020 | Contribution | 10000 | 15000 |

| 15/05/2021 | Sold | -12.433 | -29.68 |

| 12/03/2022 | Reinvestment | 19.08384 | 22.83 |

| 31/12/2023 | fmv | 10068.813 | 20018.53 |

| 31/12/2024 | fmv | 10068.813 | 17079.56 |

Additional rules for MTM:

- MTM calculations require at least one FMV row for each tax year — from the first MTM year through the filing tax year.

- FMV rows must appear at the end of the transaction list, one row per calendar year.

- The Details field must be exactly: fmv (lowercase, no extra words, spaces, or punctuation).

-

Each FMV row must include:

- Units — total units held at year-end

- Value — year-end FMV in the original currency

- Use the orange-highlighted rows in the sample table as your template.

- The calculator does not store or remember any data — every run must include full historical transactions from the first acquisition through the tax year.

- All Sale / Disposition transactions must use a negative Units value. Any positive Units is treated as an increase.

- If Units or Value is blank, fill it with 0.

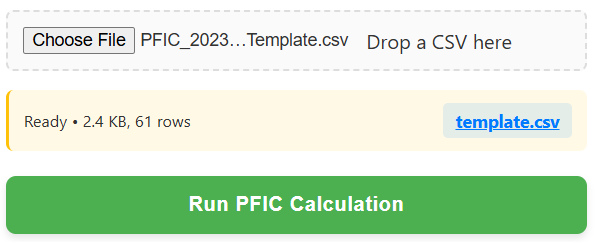

3. Upload File

Click the upload area or drag your CSV file into the box. After uploading, the panel on the right will switch to the Transaction Type Mapping section automatically.

Supported format: CSV (UTF-8 only). If starting from Excel, save as CSV before uploading.

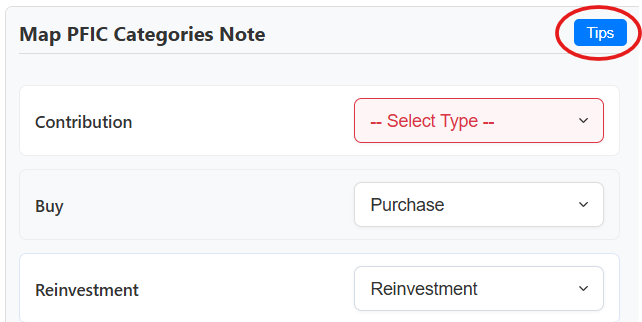

4. Category Mapping

The calculator will attempt to auto-identify categories based on the Details column, but every row must be reviewed and confirmed.

Available categories:

- Purchase

- Distribution

- Reinvestment

- Sale

- Return of Capital

- Cost Base Adjustment

- Ignore (excluded from PFIC computation)

One-page classification summary (decision logic)

Use the rules below to choose the correct Type for each transaction. Correct classification is essential for both MTM adjustments and any disposition components that must still follow FIFO.

| Units Condition | Value / Description Clues | Type (Classification Code) |

|---|---|---|

| Units > 0 | Value > 0 → real cash invested | Purchase |

| Units > 0 | Value = 0 → DRIP / reinvested dividend | Reinvestment |

| Units < 0 | Value < 0 → sale / redemption / switch-out | Sale |

| Units = 0 | Description = Dividend / Distribution / Interest | Distribution |

| Units = 0 | Description shows ROC / Return of Capital | Return of Capital |

| Units = 0 | Description shows MTM adjustment / basis adjustment | Cost Base Adjustment |

| Units = 0 | Fees / charges / NAV adjustments / internal fund tax | Ignore |

Once each row has a clear Type, the calculator can safely build MTM (§1296) adjustment schedules, UNI roll-forwards, and any related disposition components.

Special Cases — “Ignore” and Manual Mapping View Ignore Classification Guide →

Entries marked with

-- Select Type --

must be manually mapped.

All other auto-identified categories must be reviewed and confirmed

item by item — only accurate categorization will produce accurate calculations.

Any transaction marked as Ignore is excluded entirely from the calculator. Ignore items must not affect MTM income, cost basis, or Form 8621 amounts.

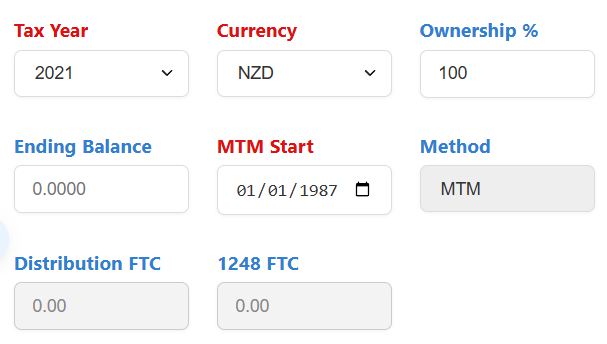

5. Configure MTM Settings

When the uploaded CSV file contains FMV rows, the calculator automatically switches to MTM (§1296).

Required:

- Tax Year — must be selected.

- Currency — must be selected.

- Ownership % — percent held by the PFIC owner.

- Ending Balance — optional; used for Form 8621 Part I, Line 4.

- MTM Start — required for MTM. Select the first tax year in which MTM (§1296) treatment applies.

- Distribution FTC and 1248 FTC — automatically disabled when MTM is selected.

When transitioning from §1291 to MTM (§1296), a purging election is required to

eliminate prior §1291 taint via a deemed FMV disposition (if applicable). The resulting

MTM opening basis is then used for all subsequent MTM years.

PFIC §1291→MTM purge transition guide

6. Run MTM (§1296) Calculation

Once all transaction categories are mapped and MTM settings are confirmed, the

green Run PFIC Calculation button will become enabled.

After verifying the tax year, currency, PFIC Start, and other required settings,

click the button to start the MTM calculation.

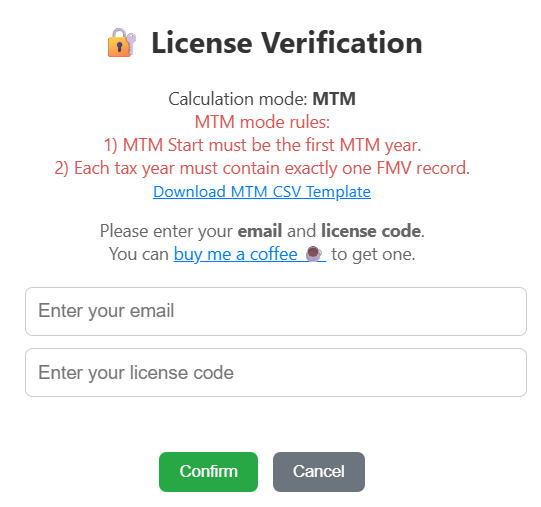

7. License Verification

After clicking Run PFIC Calculation, a license verification window will appear. You must enter your email and your license code. The calculation will only start after the license code is validated.

If you don’t have a license code, click buy me a coffee ☕ to support the tool. Send the payment screenshot by email, and you will receive a license code within one business day.

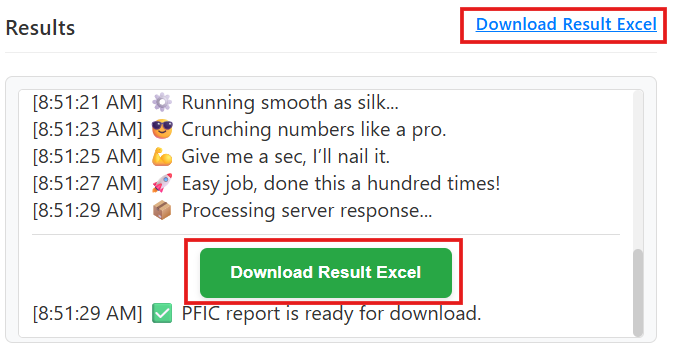

8. Download Excel Results

When the calculation is complete, a green Download Result Excel button will appear at the bottom-right of the page. A blue download link will also appear at the top-right — both point to the same file.

The calculator does not store any history. You must download the Excel file immediately after each calculation. If the page is refreshed, the file can no longer be retrieved.

9. MTM Output Sheets & Sample Workpapers

Results are delivered as an Excel workbook with multiple sheets.

B. MTM (§1296) Outputs Download Sample MTM (§1296) Result Zip

- MTM_Calculations — annual FMV and MTM calculations (Lines 10a–12), with FIFO disposition components (Lines 13–14) if applicable.

- 8621 MTM Filing Example — Part I, II, and IV mock-up (for illustration only).

- CCH_1.21_Additional — additional worksheet uploadable to CCH.

- CCH_6.2_ElectionC — Section 1296 MTM election worksheet for CCH.

- CCH_6.3_Sale1296 — CCH worksheet for MTM-related sales.

- Other IRS forms (1040, Sch 1, Sch D, 8949), if applicable.