Form 8621 Line 15e (2025 Update): 15e(1)/15e(2) Split, Foreign Currency Rules & Audit Workflow

Executive Summary

The 2025 revision of Form 8621 introduces the most significant changes to Part V in over a decade. It requires practitioners to treat the PFIC’s functional currency as the “math layer” for Lines 15a–15e(1) and only translate to USD at Line 15e(2). This article explains why the IRS implemented this structure and how to adapt your PFIC workpapers.

What Is Line 15e on Form 8621?

Line 15e represents the "Excess Distribution" portion of a PFIC distribution. Under IRC §1291, this is the amount of the current-year distribution that exceeds 125% of the average distributions from the prior three years. Unlike the non-excess portion (Line 15d), which is taxed as ordinary dividend income, Line 15e is allocated ratably over the holding period and subjected to the highest marginal tax rate together with the §1291 interest charge.

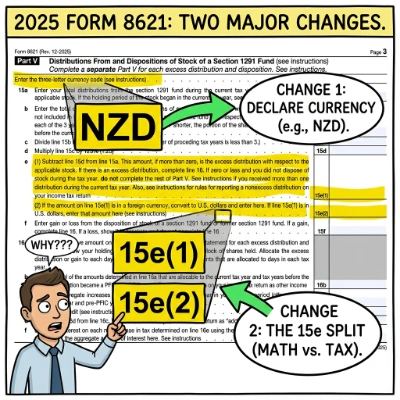

I. The Core Changes: Currency Code & Line 15e Split

The 2025 Form 8621 updates Part V to enforce a standardized method for handling foreign currency PFICs.

1. New Field: Currency Code

Above Line 15a, a new input box requires the 3-letter ISO currency code (e.g., EUR, NZD). This defines the functional currency for the excess distribution computation.

2. The Split: Line 15e(1) vs. 15e(2)

Line 15e is now bifurcated:

- Line 15e(1): Excess distribution in the declared functional currency (15a minus 15d).

- Line 15e(2): The translation of Line 15e(1) into U.S. dollars.

⚠️ Enforcement, Not New Law

This change does not introduce a new tax rule. Instead, it enforces long-standing statutory requirements under IRC §1291(b)(3) and the foreign-currency computation principles articulated in Prop. Reg. §1.1291-2(d). Under these authorities, the amount of an excess distribution must be determined in the PFIC’s functional currency before any translation to U.S. dollars.

The new 15e(1) / 15e(2) structure prevents the common practitioner error of computing the excess distribution directly in USD—an approach that contradicts the foreign-currency framework reflected in the statute and proposed regulations.

II. Why Lines 15a–15d Must Be in the Functional Currency

Under the 2025 structure, cash distributions must be entered in foreign currency. For a deep dive into the logic, read our guide on PFIC §1291 Calculation Explained — The Hidden Mechanics Behind Form 8621 Line 16a. The form is designed around specific anti-abuse policy goals.

1. Elimination of Exchange Rate Arbitrage

By forcing the subtraction (15a – 15d) to occur in the foreign currency at Line 15e(1), the IRS prevents taxpayers from using different exchange rates for distributions and baselines to artificially reduce the excess distribution.

2. Creating a Clean Audit Trail

The new structure formalizes the computation chain:

Foreign Statements (EUR) → 15a–15e(1) (EUR) → 15e(2) (USD).

This allows IRS examiners to reproduce computations directly from source documents. For a practical template on maintaining these records, see our guide on Audit-Ready PFIC Form 8621 Workpapers for EAs & CPAs.

III. The New Calculation Flow

The 2025 update converts the calculation into a step-by-step workflow, as illustrated in our PFIC §1291 Excess Distribution — Professional Case Study & Form 8621 Computational Framework. Note clearly where the currency conversion occurs:

| Step | Line Item | Currency | Action |

|---|---|---|---|

| 1 | Currency Code | N/A | Define functional currency (e.g., “NZD”). |

| 2 | 15a – 15d | NZD | Enter distributions and compute non-excess baseline in NZD. |

| 3 | 15e(1) | NZD | Compute excess distribution: 15a − 15d. |

| 4 | 15e(2) (Includes Elections E, G, H — USD Direct Entry) |

USD |

Single FX Translation Point: Convert the foreign-currency excess

distribution from 15e(1) into USD.

Deemed Dividend Elections (E, G, H) are entered directly here in USD and bypass 15a–15e(1). |

| * | Line 15f (Disposition Gain — Election F) |

USD | Direct Entry: Deemed sale gain under Election F is entered directly on Line 15f in USD. It does not pass through the 15e computation chain. |

| 5 | Line 16 | USD | Total: Sum of 15e(2) + 15f. Apply Section 1291 tax & interest. |

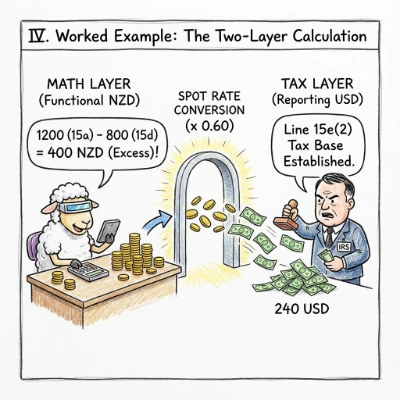

IV. Worked Example: Calculating Line 15e(1) and 15e(2)

Consider a scenario where a PFIC pays distributions in NZD.

Hypothetical Scenario

- Functional Currency: NZD

- Current Dist (Line 15a): 1,200 NZD

- Non-Excess Limit (Line 15d): 800 NZD

- Exchange Rate: 0.60 USD/NZD

(Spot rate on date of distribution)

The Computation

Step 1: Compute Excess in NZD (Line 15e(1))

Step 2: Translate to USD (Line 15e(2))

The 240 USD on Line 15e(2) then becomes the total excess distribution amount allocated over the holding period (Part V, Line 16).

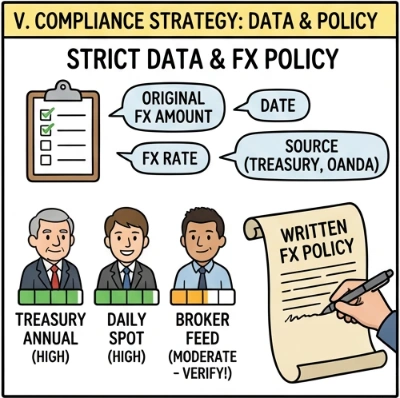

V. Compliance Strategy & FX Sources

1. Implement Strict Data Requirements

To populate Lines 15a–15e(1) correctly, your system should capture, at minimum:

- Original foreign currency amount for each PFIC distribution.

- Date of distribution.

- FX rate on that date or the annual rate applied.

- Source of FX data (Treasury, OANDA, internal feed, etc.).

2. Establish a Written FX Policy

The IRS does not mandate a single “correct” exchange rate source, but it does expect consistency. Commonly accepted sources include:

| FX Source | Acceptability for 15e(2) | Usage Note |

|---|---|---|

| Daily Spot Rate | ✔ Mandatory | Required for Line 15e(2). You must use the spot rate on the exact date of distribution. |

| Treasury Annual Average | ✖ Not appropriate for Line 15e(2) | Acceptable for QEF inclusions, but NOT for Line 15e(2) distributions. Using averages here distorts the §1291 tax. |

| Broker/Bank Feed | Moderate | Acceptable if the source provides verifiable daily spot rates (e.g., OANDA). |

3. Align PFIC Workpapers with the 2025 Structure

Workpapers built for older forms may show everything in USD. Modern PFIC tools should separate the Foreign-currency computation layer from the USD reporting layer.

Because the conversion to USD happens at a single point (15e(2)), changing FX assumptions can materially affect the final tax.

Action Item: Run sensitivity tests for high-value PFIC clients ahead of the 2026 filing season.

VI. FAQ for EAs & CPAs

Why did the IRS split Line 15e into 15e(1) and 15e(2) in the 2025 Form 8621?

Because the law has always required excess distributions to be computed in the PFIC’s functional currency before any USD translation. This requirement comes from IRC §1291(b)(3)(E), but the old Form 8621 did not reflect it, leading many practitioners to calculate the excess-distribution test directly in USD.

The 2025 split enforces the statutory sequence: 15e(1) performs the foreign-currency computation, and 15e(2) performs the single allowed translation to USD. This closes the long-standing loophole where separate FX translations of 15a and 15d could create unintended currency distortions in the §1291 regime.

Q1. Should I use USD or foreign currency for Lines 15a–15d?

Use the PFIC’s functional currency (entered in the currency-code box). Lines 15a, 15b, 15d, and 15e(1) should all be computed entirely in foreign currency.

Q2. What if the PFIC is held in a USD brokerage account?

If the distribution is actually paid in USD, choose “USD” as the currency code. In that case, 15e(1) (math) equals 15e(2) (translation), but the two-step structure still applies conceptually.

Q3. Does the first year of holding ever trigger Line 15e?

Normally no, because the excess distribution is defined relative to the prior three years of distributions. First-year PFICs generally have zero excess unless an Election E/G/H applies, or a disposition event triggers Line 15f.

Q4. Did 15e(1) and 15e(2) replace the old single Line 15e?

Yes. The IRS retired the single-line 15e. You can no longer enter one USD number without showing the foreign-currency computation.

Q5. How do I report Deemed Dividend Elections (Elections E, G, H)?

2025 Critical Change: The instructions now explicitly require Elections E, G, and H to be entered directly on Line 15e(2) in USD.

They do not go into Line 15a, and they bypass foreign currency rules entirely. Election F (Deemed Sale) continues to go on Line 15f.

Q6. Does Line 15e apply to Mark-to-Market (MTM) PFICs under §1296?

No. If a valid MTM election exists, distributions and MTM adjustments appear in Part IV (Lines 13–14). Line 15e is for §1291 default-regime PFICs only.

Q7. Does Line 15e flow to Schedule B (Interest & Dividends)?

No. Line 15e(2) itself never goes straight to Schedule B.

- The non-excess portion on Line 15d is the amount that flows to Form 1040 Schedule B as dividend income.

- The excess portion (Line 15e) is allocated over the holding period in Line 16a. Only the slice allocated to the current year (and pre-PFIC years) on Line 16b is included in current-year taxable income (usually as "Other Income" on Schedule 1).

Q8. Do I need to attach an Excess Distribution Statement?

Yes — always. If Line 15e(2) or Line 15f is greater than zero, the IRS requires an attached statement supporting the Section 1291 calculation.

The form itself only reports summary totals. The attached statement is the only place where you show the required allocation of the excess distribution to each tax year in the holding period.

- Show the Total Excess Distribution (or deemed gain).

- Show the Number of days in each tax year of the holding period.

- Show the Allocation of the excess distribution to each year (including the current year).

- Show which portion becomes current-year income (Line 16b) and which portion becomes deferred tax + interest (Lines 16c–16f).

E-filing systems routinely reject Form 8621 without this statement, and IRS examiners treat a missing statement as a material deficiency because the tax shown on Line 16 cannot be verified.

Q9. How are multiple currencies handled?

You cannot mix currencies inside one Part V. If a PFIC produces distributions in multiple currencies, prepare one Part V per currency, or file separate Form 8621s.

Q10. Does Line 15f (Disposition Gain) also follow the foreign-currency rule?

No — not in the same way as Line 15e. Line 15f is always reported in U.S. dollars, using the normal U.S. tax rules for gains and losses on PFIC stock.

For foreign-currency accounts, you generally:

- Translate the purchase price into USD using the spot rate on the acquisition date;

- Translate the sale proceeds into USD using the spot rate on the disposition date; and

- Compute the USD gain or loss (proceeds minus adjusted basis) — this USD result is what you report on Line 15f.

Q11. Which exchange rate should I use for 15e(2)?

Strictly the Spot Rate. Unlike income inclusions (which may sometimes use average rates), actual cash distributions MUST be translated using the spot rate on the date of distribution (IRC § 989(b)(1)).

Do not use annual averages. The draft instructions mandate using the spot rate. Using an average rate can distort the excess distribution calculation and is non-compliant.

Q12. Can the 2025 structure be applied to earlier years?

For workpapers — Yes. Using the 2025 foreign-currency workflow (15e(1) → 15e(2)) to rebuild older §1291 years is correct and makes the PFIC history consistent.

For actual filing — No. You must use the Form 8621 version applicable to that tax year. The 2025 split cannot be retroactively inserted into prior-year forms.

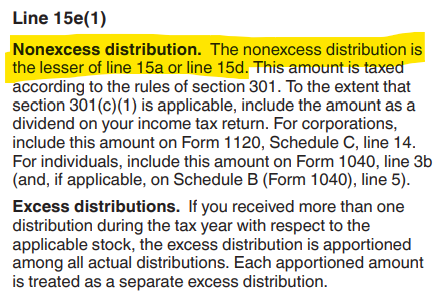

VII. Technical Analysis: The "Must" Clause & Methodology

A detailed review of the 2025 Instructions language confirms that the structural changes to Line 15e are more than cosmetic. The updated text introduces rigid constraints on currency methodology that were previously implicit.

"However, if all distributions... are made in a single foreign currency, the excess distribution must be calculated in the currency in which the distributions are made."

The mandatory language ("must") effectively eliminates the "USD-first" shortcut. You cannot translate distributions to USD before the test; you must perform the test in foreign currency.

1. The Single Translation Point

The draft instructions clarify the exact moment of currency conversion. The excess amount (Line 15e(1)) is translated to U.S. dollars using the spot rate on the date of the distribution. This precludes the use of average rates for the excess calculation itself.

2. Drafting Anomaly: Line 15e(1) Labeling

Practitioners should be careful with the text under Line 15e(1) in the draft instructions.

As shown in Exhibit A, the header reads "Line 15e(1) Nonexcess distribution," and the text correctly defines non-excess as the lesser of line 15a or 15d.

While the definition of non-excess is correct, Line 15e(1) itself must be used for the Excess Distribution (the amount remaining after subtracting the non-excess).

If you were to enter the Non-Excess amount on Line 15e(1) as the header suggests, you would incorrectly subject your ordinary dividends to the punitive §1291 tax and interest charge on Line 16.

Compliance Tip: Ignore the header label. Ensure Line 15e(1) reflects the Excess Distribution (Line 15a minus Line 15d) in foreign currency.

3. Section 902 Credit Note

The draft also includes a new note alerting 10%-or-greater corporate shareholders to potential deemed-paid foreign tax credits under Section 902 for pre-2018 earnings—a critical planning point for institutional filers.

VIII. Summary & Takeaways

By requiring the excess-distribution test to be reflected first in the PFIC’s functional currency, the form now makes explicit that currency translation is a downstream reporting step, rather than part of the testing methodology itself.

The 2025 redesign shifts Form 8621 toward a more transparent review structure. It visually and mechanically separates the economic measurement of a distribution (in the PFIC’s functional currency on Line 15e(1)) from its U.S. tax reporting consequence (the translated USD amount on Line 15e(2)).

Practical implication for practitioners: Workpapers that implicitly determine the 125% excess-distribution threshold using USD-converted amounts no longer align with the form’s structure. Post-2025, the defensible approach is to determine whether a distribution is “excess” strictly in the functional currency, using exchange rates solely as a translation mechanism after that determination is complete.

Practitioners should expect that functional-currency testing must be demonstrable in the Line 16a attached statement, not merely inferable from internal workpapers.

For a discussion of how structural calculation errors differ from missed filings in terms of compliance exposure, see Missed vs Incorrect Filing: The Statute of Limitations Trap .