Form 8621: Missed Filing vs. Incorrect Filing — Statute of Limitations & Audit Exposure Guide

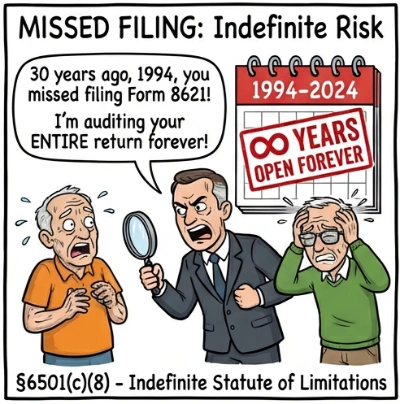

- Missed Filing: Triggers IRC §6501(c)(8), leaving the tax year open indefinitely for assessment.

- Incorrect Filing: Generally starts the 3-year (or 6-year) statute of limitations, capping exposure.

- Audit Risk: An unfiled Form 8621 technically exposes the entire Form 1040 to audit, not just the PFIC item.

- Professional Risk: Preparers face indefinite malpractice exposure and Circular 230 sanctions for missed international forms.

Executive Summary

The reporting regime for Passive Foreign Investment Companies (PFICs) is far more punitive than other foreign information filings. For tax practitioners, distinguishing between a missed filing and an incorrect filing is critical, as they trigger dramatically different statutes of limitations under IRC §6501.

I. Missed Filing = Indefinite Statute of Limitations (Highest-Risk Scenario)

Authority: IRC §6501(c)(8)

Failure to file Form 8621 for a PFIC subject to §1298(f) reporting requirements leaves the tax year open indefinitely. This is consistently viewed as one of the highest-risk failure points in international tax compliance.

1. The Statute of Limitations Does Not Begin to Run

Under §6501(c)(8)(A), the IRS may assess tax “at any time” until the required PFIC information is furnished. This is not merely an extension; it effectively prevents the Statute of Limitations (SOL) from starting.

Taxpayer A held a PFIC from 2012–2020 and sold it in 2020. They filed their Form 1040 timely each year but omitted Form 8621.

Result:

Despite the general 3-year statute expiring, the IRS retains the authority to audit all years from 2012 through 2020.

If an audit begins today, the examiner can assess §1291 tax and interest going back to 2012, effectively ignoring the standard limitation periods.

2. IRS May Examine the Entire Return

While §6501(c)(8)(B) limits the extended statute to the PFIC item if "reasonable cause" is shown, the burden of proof is on the taxpayer. Without it, the default position for unfiled international forms often exposes the entire Form 1040 to audit.

See IRM 20.1.9 (International Penalties) for examiner guidelines on assessing penalties for failure to file information returns.

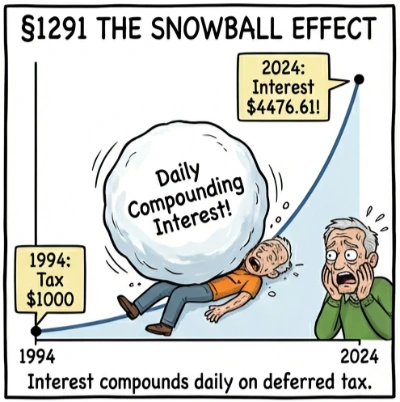

3. §1291 Interest Compounds Daily

Under IRC §1291(c), the deferred tax charge attracts daily compounded interest calculated from the original due date of the return.

Technical Note: Interest applies separately to each "allocation year" per §1291(c)(3). For a deep dive, see our guide on PFIC Interest Calculation Mechanics.

II. Incorrect Filing = 3–6 Year Statute (Finite Exposure)

Authority: IRC §6501(a), §6694

1. Filing Starts the Clock

The critical distinction is that filing the form—even with errors—triggers the assessment period.

- Standard Period: 3 years per §6501(a).

- Substantial Omission: 6 years per §6501(e)(1)(A) if omitted gross income exceeds 25%.

Filing an imperfect Form 8621 is legally superior to not filing at all. It converts an "infinite" risk into a managed, finite risk.

2. The Danger Zone: The "Beard Doctrine"

Under the Supreme Court's Beard test, a return is only valid if it meets four criteria:

- It must contain sufficient data to calculate tax liability.

- It must represent an honest and reasonable attempt to satisfy the tax law.

- It must purport to be a return.

- It must be executed under penalties of perjury.

A Form 8621 filed with "See Attached" but no calculation statement fails this test and does not toll the statute. For a detailed breakdown of the required attachment logic, see PFIC §1291 Calculation Explained — The Hidden Mechanics Behind Form 8621 Line 16a.

III. Risk Comparison Matrix

A summary of exposure based on filing status:

| Scenario | Statute of Limitations (SOL) | Audit Scope | Interest Type | Practitioner Risk |

|---|---|---|---|---|

| Missed Filing | Indefinite (Never Starts) | Entire Form 1040 | Daily Compounding (§1291) | Extreme |

| Incorrect Filing | 3–6 Years | Limited to PFIC Item | Simple Interest (§6621) | Moderate |

| De Minimis | N/A (Exempt) | None | None | Low |

IV. De Minimis Exception: A Statutory Exemption

Authority: Treas. Reg. §1.1298-1(c)(2)

Practitioners must distinguish between a compliance failure and a statutory exemption.

De Minimis Criteria (Must meet ALL):

- Aggregate PFIC value ≤ $25,000 (or $50,000 MFJ).

- No excess distributions received during the year.

- No disposition of PFIC stock during the year.

- No QEF or MTM election is currently active.

- Indirect ownership threshold ≤ $5,000.

For a comparison of election types, see QEF vs MTM vs §1291 — Decision Framework.

V. Remediation Workflow: Closing an “Open Year”

Remediation typically involves filing delinquent forms for open years (usually 3–6 years). Accurate calculation requires a full historical reconstruction.

PFIC Remediation Workflow (Recommended by Practitioners)

- Identify PFIC Years: Determine the start of the holding period.

- Retrieve Transaction History: Gather all buy/sell/dividend data.

- Reconstruct Basis (FIFO): Match lots strictly (No Average Basis). See Why Excel Fails for PFIC.

- Allocate Excess Distributions: Apply §1291 ratio to prior years.

- Compute Interest: Calculate daily compounded interest per allocation year.

- File Delinquent 8621s: Submit forms to start the statute of limitations. Once filed, the limitation period begins under §6501(a), even for previously open years.

1. Why Excel is Insufficient for Remediation

Spreadsheets lack the rigid logic controls required for §1291 compliance. Common failure points include:

- Failure to track FIFO lot matching.

- Inability to lookup historical U.S. marginal tax rates.

- Lack of Undistributed Earnings tracking.

See Audit-Ready PFIC Workpapers for examples of required documentation.

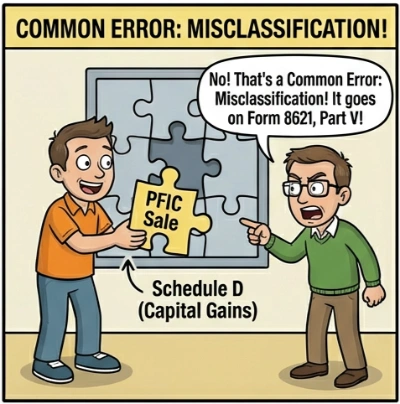

VI. Common Practitioner Errors

We frequently observe the following compliance errors in amended returns:

- Netting Gains and Losses: Improperly offsetting PFIC losses against PFIC gains. (Note: §1291 does not permit loss recognition until final disposition. See Can PFIC Gains and Losses Be Netted? — The §1291 Multi-Lot Disposition Trap).

- The "Zero Distribution" Fallacy: Assuming no distributions means no filing is required (ignoring the aggregate value check).

- Misapplication of the Threshold: Believing the $25,000 exception applies even when there is a disposition or excess distribution.

- Misclassifying Dispositions: Reporting PFIC sales on Schedule D as capital gains instead of Form 8621 Part V.

- Incomplete Disclosures: Filing the form with only the Entity Name, leaving financial data blank.

VII. Frequently Asked Questions

1. If my client missed Form 8621, do I need to amend the Form 1040?

If the recomputation creates additional Section 1291 or Section 1296 tax, an amended return is generally required so the underpayment can be assessed. If the year has no PFIC tax effect, practitioners commonly file the missing Form 8621 (sometimes with a “no-change” 1040-X) simply to start the statute of limitations under §6501(c)(8).

2. A prior PFIC calculation was wrong — how far back should I recompute?

The most reliable method is to rebuild the PFIC history from the beginning. For both §1291 and §1296, any error in distributions, MTM adjustments, or basis figures makes all subsequent years unreliable. And because identifying the first inaccurate year usually takes more time than reconstructing the entire timeline, starting from year one produces the cleanest and most defensible result — you can’t repair a bad foundation; you rebuild it.

3. If the PFIC was sold at a loss and there is no tax, do I still need to file Form 8621?

Yes. Under §1298(f), a disposition is a reportable PFIC event even if the transaction produces no §1291 tax. For a §1291 fund, a pure loss bypasses §1291 and is reported under normal capital-loss rules (Schedule D, including the $3,000 annual limitation), but Form 8621 is still required to close the PFIC reporting year. Under §1296 MTM, Form 8621 is required every year during an active MTM election, regardless of gain, loss, or whether stock was sold.

VIII. Professional Risk to EAs & CPAs (What’s at Stake?)

Even when the client bears the tax, the preparer bears the professional risk. The following risk areas are frequently cited by malpractice insurers:

1. No Statute of Limitations on Your Work

If Form 8621 was never filed, the tax year is never closed. This means your malpractice exposure also remains open indefinitely. Clients (and their lawyers) can theoretically pursue damages for negligent preparation 10 years later.

2. Preparer Penalties (§6694)

Errors on PFIC returns may trigger penalties of up to $5,000 per return for willful or reckless conduct.

3. Circular 230 Sanctions

Failure to exercise diligence in preparing international returns may violate Circular 230 §10.22 and §10.34. Violations can lead to censure, suspension, or disbarment from practice before the IRS.

4. Reputational Damage

PFIC mistakes often lead to costly multi-year amendments and interest charges that cannot be abated. EAs and CPAs report that PFIC-related errors generate a disproportionate number of negative client reviews and fee disputes.

IX. Summary & Practitioner Takeaways

Action Plan for Remediation:

- Assess Exposure: Determine if failure was due to reasonable cause.

- Reconstruct History: Use strict FIFO logic for every lot.

- Use Specialized Tools: Ensure daily interest factors are calculated correctly.

- File Delinquent Forms: Submit missing forms to start the statute of limitations running.

IRC §6501(c)(8) — Assessment period for international information returns

IRC §1291 — Taxation of excess distributions

Treas. Reg. §1.1298-1 — PFIC reporting requirements

IRM 20.1.9 — International Penalties