Form 8621 Line 16a Statement — The Mandatory Audit Checklist Under PFIC §1291

Line 16a is not a “nice-to-have worksheet.” It is the IRS’s explicit demand for a statement that can be independently recomputed: per-share (or per-block) holding period, per-day allocation, and per-year totals.

1. The Common Misunderstanding

Form 8621 Line 16a is widely misunderstood in practice. It is often treated as a mechanical allocation step — a place to “spread numbers” across prior years after the tax has already been computed.

That interpretation fundamentally misapplies the statute.

It is a mandatory, audit-grade statement required whenever a PFIC excess distribution or disposition is reported under IRC §1291. In substance, Line 16a functions as an audit checklist: a legally required demonstration that the PFIC computation can be independently verified.

2. The Explicit Requirement Behind Line 16a

The Instructions to Form 8621 provide the operative mandate:

"If there is a positive amount on line 15e(2) or line 15f (or both), attach a statement for each excess distribution and disposition. Show your holding period for each share of stock or block of shares held. Allocate the excess distribution or gain to each day in your holding period. Add all amounts that are allocated to days in each tax year."

While Form instructions are guidance rather than statutes, failure to follow them can render the PFIC disclosure substantially incomplete for purposes of the PFIC reporting regime under IRC §1298(f). The Line 16a mandate implements the reporting obligations imposed by §1298(f) and the regulations under §1291, including Treas. Reg. §1.1291-9 (governing excess distributions and deemed dispositions).

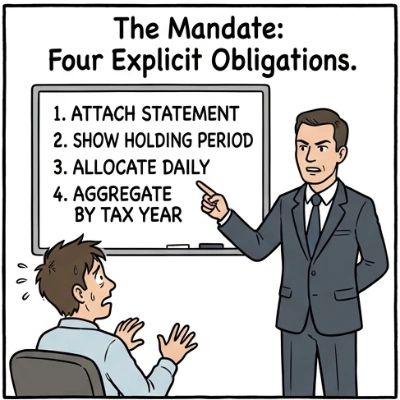

This language imposes four distinct and mandatory disclosure obligations:

- A statement must be attached for each excess distribution and disposition.

- Holding period must be shown for each share or qualifying block of shares.

- Amounts must be allocated to each day of the holding period (not estimated by year).

- Daily amounts must be aggregated by tax year after daily allocation is completed.

These are not computational suggestions. They define the minimum information that must be furnished for a PFIC §1291 computation to be auditable.

Important: A “block of shares” is not “everything acquired in the same year.” It is a practical grouping only where the shares are acquired on the same date, at the same cost basis, and held continuously.

Line 16a does not exist to improve numerical accuracy. It exists to enforce legal transparency. Even where the ultimate tax liability is numerically correct, a missing or deficient Line 16a statement can be treated as a failure to furnish required PFIC information.

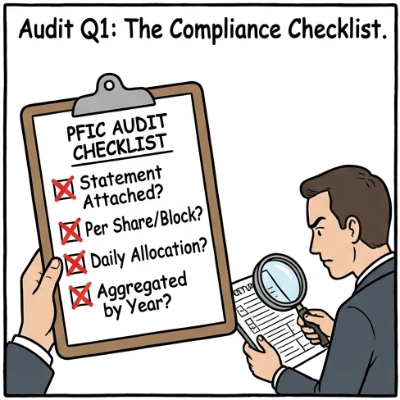

3. Audit Question #1: Compliance

Does the filing comply with every Line 16a requirement?

This is the threshold issue. The IRS will examine, verbatim:

- Was a statement attached?

- Is the disclosure per share or per block, rather than aggregated?

- Is the allocation daily, rather than annual or estimated?

- Are amounts clearly aggregated by tax year?

Failure on any point constitutes noncompliance, regardless of the size or accuracy of the tax liability. This is a disclosure test, not a rounding test.

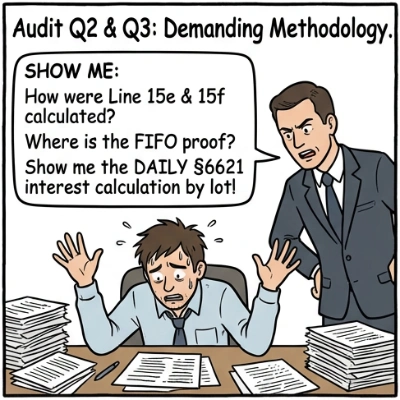

4. Audit Question #2: Methodology

How were Line 15e and Line 15f calculated? Show me.

Once formal Line 16a compliance is established, the audit turns to substance. Line 16a necessarily exposes the methodology underlying:

Line 15e — Excess distributions must be computed per lot

Each PFIC lot has its own acquisition date and holding period. Those attributes determine which prior years may be included in the Line 15b base period, and whether the current-year distribution exceeds the statutory threshold.

The “Block” Rule: A “block of shares” may be used only where shares were acquired on the same date, at the same cost basis, and held continuously. Grouping by tax year is not permitted.

Line 15f — FIFO as the default audit-defensible method

Unless the taxpayer has maintained contemporaneous specific-identification records (with broker-level support), FIFO is the default and most defensible method. FIFO is not presented as a “trap” — it is the audit-friendly way to prove which shares were sold.

Without FIFO lot tracking, it is impossible to construct a compliant Line 16a statement for partial sales.

For a deeper explanation of why Line 16a forces “per-lot math,” see: PFIC §1291 Calculation Explained — The Hidden Mechanics Behind Line 16a.

5. Audit Question #3: Tax & Interest

How were tax and IRC §6621 interest calculated by year? Show me.

Line 16a’s daily allocation is not the end of the analysis — it is the foundation for computing tax-by-year and interest-by-year. If you cannot show the daily allocation and the annual aggregation, you cannot prove the tax and interest mechanics.

- Daily allocation by lot

- Aggregation by tax year

- Application of the applicable annual tax rate (often modeled using the highest marginal rate for the year, depending on the method used)

- Separate IRC §6621 interest computation for each lot and each year

- Final aggregation

Interest is not computed on a single lump-sum tax amount. It accrues year by year, lot by lot, based on the Line 16a allocation. For a focused treatment of dates and daily compounding mechanics, see: PFIC §1291 Interest — Due Dates & Daily Compounding.

6. Distinction: Substantive Noncompliance vs. Computational Error

This distinction is critical:

- A computational error may result in an adjustment.

- Failure to comply with Line 16a can be treated as a failure to furnish required PFIC information.

Even a correct tax result does not cure a defective Line 16a statement. The issue is not merely accuracy — it is whether the taxpayer has furnished the information required so the computation can be fully recomputed.

7. Illustrative Line 16a Statement Example (Downloadable Excel Template)

The IRS has never published an official template or sample for a Line 16a statement. The illustrative attachment below is provided solely to show what a recomputable Line 16a disclosure looks like in practice under IRC §1291 and the Form 8621 Instructions.

This example is not authoritative, not IRS-endorsed, and not presented as the only acceptable format. It reflects a practitioner-designed structure intended to satisfy the statutory disclosure requirements: per-lot holding periods, daily allocation, and aggregation by tax year.

Practitioners with alternative or improved disclosure formats are welcome to share them for professional discussion.

Reference Template: Form 8621 Line 16a Statement (Excel)

This Excel template illustrates a Line 16a statement structure designed to support an independently recomputable PFIC §1291 excess distribution or disposition calculation, including per-lot holding periods, daily allocation, and aggregation by tax year.

Download Example: Form 8621 Line 16a Statement (Excel Template)8. Statute of Limitations & Client Risk

The illustrative disclosure above shows what Line 16a compliance looks like in practice. The consequences of failing to provide such information extend far beyond the PFIC tax itself.

IRC §6501(c)(8) — Suspension of the Statute of Limitations

The gravest risk of a missing or defective Line 16a statement is not the PFIC tax itself. Under IRC §6501(c)(8), if a taxpayer fails to furnish information required under IRC §1298 (including a complete PFIC disclosure), the statute of limitations for the entire income tax return (Form 1040 or Form 1120) may not begin to run until the information is furnished.

This is why Line 16a defects are not “minor workpaper issues.” They can create procedural exposure that extends beyond the PFIC computation itself.

Client Risk — Beyond the Calculation

For taxpayers, defective Form 8621 reporting can result in:

- Expanded audit exposure beyond PFIC items

- Reopening of prior years

- Recomputed tax, interest, and penalties

Once the taxpayer is harmed, professional liability exposure for the preparer follows naturally. This is not merely a technical compliance issue — it is a material risk management issue.

Audit Scope Expansion — Why Line 16a Errors Are Rarely Treated as Isolated

In practice, IRS examinations do not focus solely on individual line items. They evaluate whether a computation framework is compliant and consistently applied.

When a Line 16a statement fails to meet the statutory disclosure requirements— such as per-lot holding periods, daily allocation, or reproducible annual aggregation— the issue is not viewed as a one-off arithmetic mistake. It is viewed as a methodological defect.

From an examiner’s perspective, a methodological defect raises a natural follow-up question:

"Was this same non-compliant method used for other PFIC positions or other tax years?"

This is why Line 16a deficiencies can expand audit scope. If the methodology itself is noncompliant, the IRS has a reasonable basis to re-examine other PFIC filings prepared using the same approach—particularly where the same preparer, template, or process was involved.

This is not punitive. Audits follow patterns, not isolated numbers.

9. Frequently Asked Questions About Form 8621 Line 16a

Q1. Is the Form 8621 Line 16a statement (attachment) mandatory?

Yes. The Instructions to Form 8621 explicitly require you to attach a statement whenever there is a positive amount on Line 15e(2) or Line 15f (or both). Entering only totals on the face of the form is insufficient. The attachment must demonstrate the holding period, daily allocation, and annual aggregation required under IRC §1291.

Q2. What exactly must be shown in a Line 16a statement?

At a minimum, the Line 16a statement must be sufficient for an independent recomputation and should show: (1) each PFIC share or qualifying block; (2) acquisition date and basis; (3) holding period; (4) the daily allocation of the excess amount or gain; and (5) the aggregation of those daily amounts by tax year.

In practice, many practitioners attach a PDF schedule generated from an external calculation worksheet or specialized PFIC computation tool.

Q3. Can I use average cost or aggregate PFIC lots acquired in different years?

No. Line 16a requires the holding period for each share or qualifying block and a daily allocation based on that holding period. Using average cost or aggregating lots with different acquisition dates destroys the ability to verify the daily allocation and renders the statement non-compliant.

Q4. Does Line 16a apply to MTM (§1296) or QEF (§1295) elections?

No. Line 16a applies only to the Section 1291 excess distribution and disposition regime. It is not a statement requirement for MTM or QEF PFICs, although other reporting lines will apply under those regimes.

Q5. Why doesn’t professional tax software generate a Line 16a statement automatically?

Most commercial tax software treats Form 8621 as a form-filling exercise rather than a historical calculation engine. Section 1291 requires per-lot tracking, daily allocation, and multi-year interest computation, often spanning decades. As a result, the calculation is typically performed outside the software and attached as a Line 16a statement.

Q6. If my PFIC tax result is correct, why does a defective Line 16a statement still matter?

Because the issue is not merely numerical accuracy. The question is whether the taxpayer has furnished the information required so the computation can be fully recomputed. A correct tax result does not cure a missing or non-compliant Line 16a statement.

Q7. What is the real risk under IRC §6501(c)(8)?

IRC §6501(c)(8) can suspend the statute of limitations if required international-information reporting under IRC §1298 is incomplete. A missing or defective Form 8621, including required Line 16a statements, may prevent the statute of limitations from beginning to run for the entire tax return until the information is properly furnished.

Q8. Why is FIFO emphasized for Line 15f PFIC dispositions?

In an audit, the core question is: which shares were sold? Unless the taxpayer has contemporaneous specific-identification records, FIFO (First-In, First-Out) is the default and most defensible method to identify disposed shares and support the holding-period and allocation mechanics required by Line 16a.

Q9. Is there an example or template for a compliant Line 16a statement?

The IRS has never published an official Line 16a template or sample. However, practitioners often rely on internally developed schedules. This article includes an illustrative Line 16a statement example, with a downloadable Excel template designed to support a fully recomputable PFIC §1291 disclosure.