PFIC Form 8621: A Taxpayer Trap & CPA Nightmare (Why the IRS Created Section 1291)

If you have ever held a foreign mutual fund or ETF, you have likely heard your accountant say: "This form is expensive, and it is trouble."

Why does a simple $500 dividend turn into a $2,000 filing fee? Why do CPAs refuse PFIC clients?

The PFIC regime (§1291) is designed as a punishment mechanism against capital that leaves the U.S. tax net. It imposes severe penalties on funds the IRS cannot easily supervise.

1. The IRS Logic: You Are Not Investing, You Are "Stealing Time"

To understand the punishment, you must understand the IRS's perspective. They view US funds and Foreign funds completely differently:

| Fund Type | Tax Event | IRS View |

|---|---|---|

| 🇺🇸 US Funds | Pay Yearly | Normal ✅ |

| 🌍 PFIC | Deferred | "Time Theft" ❌ |

In the eyes of the IRS: You are using an "interest-free loan" from the government to grow your wealth.

Therefore, the goal of Section 1291 is clear: Claw back all the deferred tax from the past, plus interest and penalties.

2. Section 1291 — The Three "Punishment Mechanisms"

This is why CPAs sigh when they see your statement.

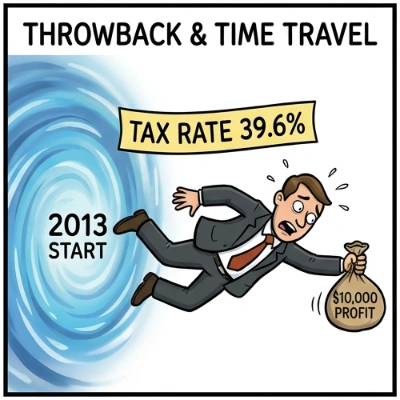

Penalty #1: The "Throwback" (Time Travel)

Imagine you held a PFIC from 2013–2023 and sold it for a $10,000 gain. The IRS assumes you earned a little bit of that money every single day for the last 10 years.

You must "simulate" re-opening your tax returns for 2013, 2014, 2015... all the way to today. This is the first level of PFIC hell.

Penalty #2: Highest Marginal Tax Rate

Even if you had zero income that year, the IRS forces you to pay tax at the highest marginal rate (e.g., 39.6% or 37%).

IRS View: "Since you enjoyed deferral, we will tax you at the worst-case scenario."

The math itself isn't just "hard"—it's logistically overwhelming.

The IRS interest rate floats quarterly and compounds daily.

To calculate this correctly for a 10-year holding, you need to maintain a database of 40+ historical interest rates and map them day-by-day to every single allocated gain fragment.

Maintaining this dynamic data structure manually in Excel is error-prone and impractical.

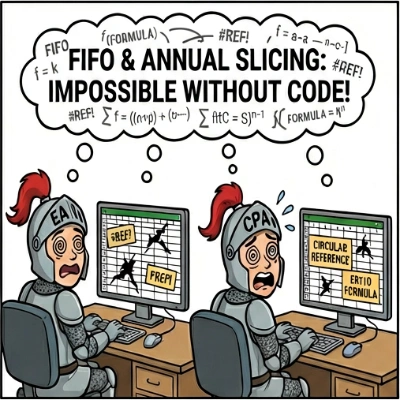

3. Why Excel Almost Always Fails (Even for Experts)

CPAs aren't bad at Excel. The problem is that Section 1291 is not a formula; it is a multi-dimensional algorithmic system.

🔥 Failure Point 1: FIFO Multi-Lot Fragmentation

Real-world data is messy. You have multiple buys, multiple sells, and dividends. To calculate this correctly, you must:

- Split holdings into Lots based on FIFO.

- Slice each Lot by Tax Year for throwback.

- Slice each Year by Day for interest.

A single PFIC holding can turn into: 50 Lots × 10 Years × Daily Interest Ranges.

Without VBA code, Excel cannot handle this dynamic splitting logic.

🔥 Failure Point 2: Daily Interest Mapping

You need to map a sequence of days against the IRS quarterly interest rate table from 1987 to today. If someone can do this purely in Excel (without macros), they should be selling software, not doing taxes.

🔥 Failure Point 3: The "Exponential Error"

One wrong basis adjustment in Year 2 ruins the throwback calculation for Year 3, Year 4, and Year 10. Any manual PFIC spreadsheet becomes unreliable after the 2nd or 3rd year.

4. Why CPAs Avoid PFIC Clients

Most firms reject PFIC work not because they can't do it, but because the risk does not match the reward.

- Huge Workload: 10+ hours of historical reconstruction per fund.

- High Liability: A calculation error can trigger an indefinite statute of limitations (IRC §6501(c)(8)), putting the CPA's license at risk.

- Client Resistance: Clients hate paying $2,000 in fees to report a measly $500 dividend.

5. The Ultimate Solution: Fight Math with Math

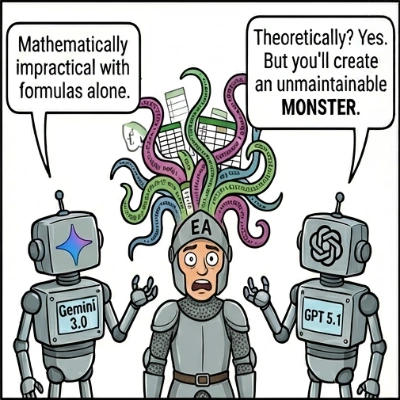

The PFIC regime was engineered with a singular goal: to stop wealthy taxpayers from deferring U.S. tax through offshore investments. To ensure nothing slipped through, Congress cast an exceptionally broad net, deliberately combining punitive taxes, high interest, and extreme calculation complexity with an indefinite statute of limitations for failure to file.

Due to this overwhelmingly broad scope, ordinary Americans living and working abroad often inadvertently fall into this tax trap, as their local pension plans almost universally trigger PFIC rules. This creates a professional nightmare for the CPAs and EAs tasked with battling this incredibly powerful compliance dragon.

"Section 1291 existed a year before Excel was born. For decades, professionals tried to tame this PFIC monster with spreadsheets — the monster won every time.

To challenge a 40-year-old algorithmic creature, you need an algorithmic weapon, not a worksheet.

Stop swinging a wooden sword at a PFIC dragon — choose a tool built for the fight."

PFIC Calculator (pfic.xyz) Design Principles

- Auto-Throwback: Instant allocation to prior years.

- Auto-FIFO: Dynamic lot splitting logic.

- Auto-Interest: Daily mapping to IRS §6621 rates.

- Audit-Ready: Generates the exact workpapers an auditor expects.

6. Frequently Asked Questions

Why is PFIC tax so high?

Because Section 1291 assumes you "deferred" tax for years. It claws back that deferral by applying the highest marginal tax rate plus a daily compounded interest penalty.

Is there a PFIC Section 1291 calculation example?

Yes. Every excess distribution is split into pieces allocated to each prior tax year. Each piece is then taxed at the top rate for that year, and interest is added daily from that year's due date until today. (See our detailed Step-by-Step Case Study).

Why can't Excel or TurboTax calculate PFIC correctly?

Because it requires a multi-dimensional computation engine: FIFO lot matching, dynamic year-by-year allocation, and daily mapping of IRS interest factors. Excel formulas cannot handle this dynamic loop logic.

Read the full analysis: Why Your Tax Software Can’t Calculate PFIC →

How many years back does PFIC calculation go?

The algorithm must trace back to the first day of your holding period. Even if you only file for the current year, the underlying math must cover the entire history.

How many years can the IRS go back when reviewing a PFIC calculation?

In many cases: unlimited. If Form 8621 is incomplete or incorrect, the IRS can keep the return open indefinitely under IRC §6501(c)(8). This is why PFIC work is considered high-liability for firms.

Does the IRS really require day-by-day interest for PFIC?

Yes. Section 1291(c)(3) applies the IRS underpayment interest rate compounded daily, and the rate resets every quarter. For a 10-year holding period, that means mapping 40+ rate changes to thousands of days.

Is there any shortcut for the throwback calculation?

No. Although many practitioners attempt “annual allocation shortcuts,” the statute requires actual allocation of excess amounts to each prior year and calculation of tax for that specific year. There is no legal shortcut.

What happens if I have both sales and distributions in the same year?

This is one of the most error-prone scenarios. You must first run FIFO matching, then split each lot into fragments, and identify excess distribution portions separately before applying throwback.

Most spreadsheets cannot perform this multi-branch logic tree without breaking.